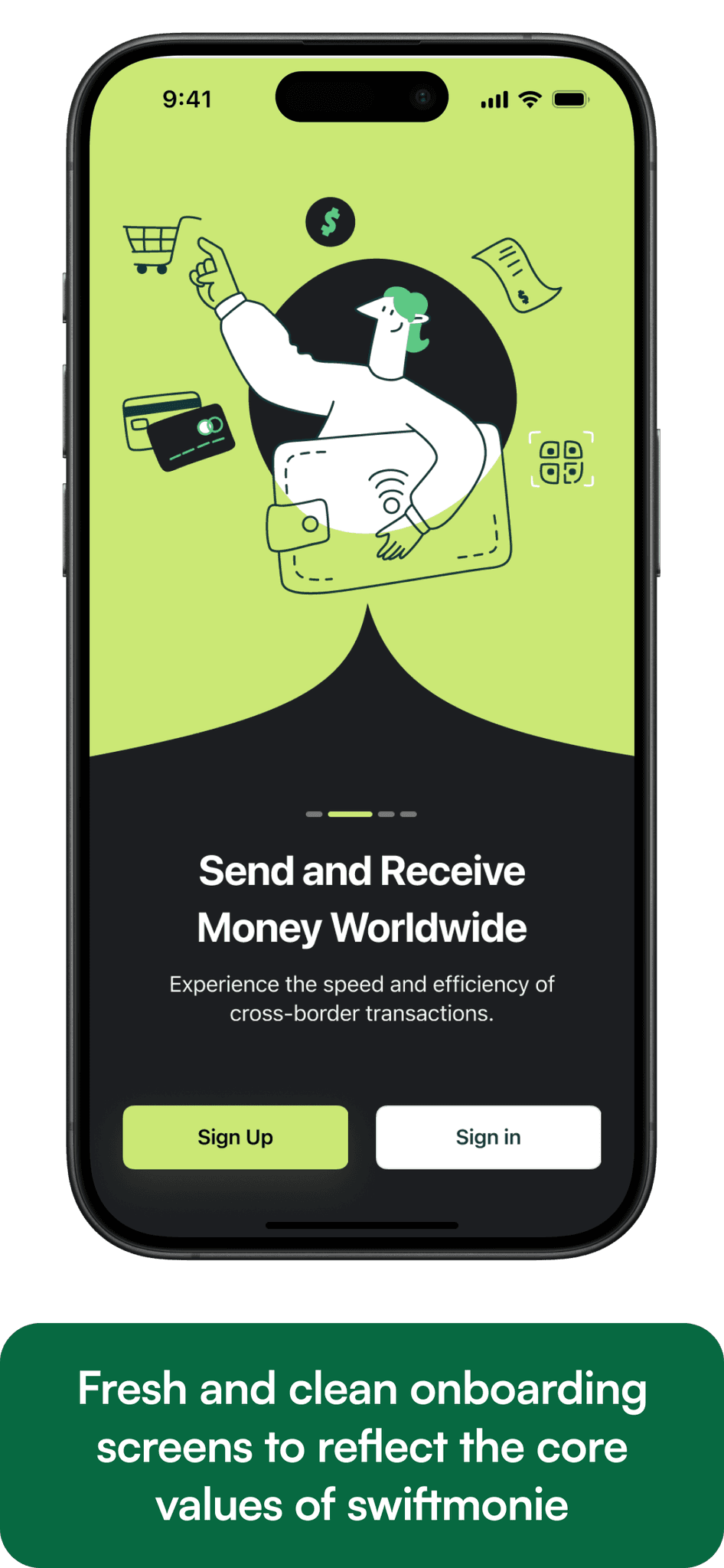

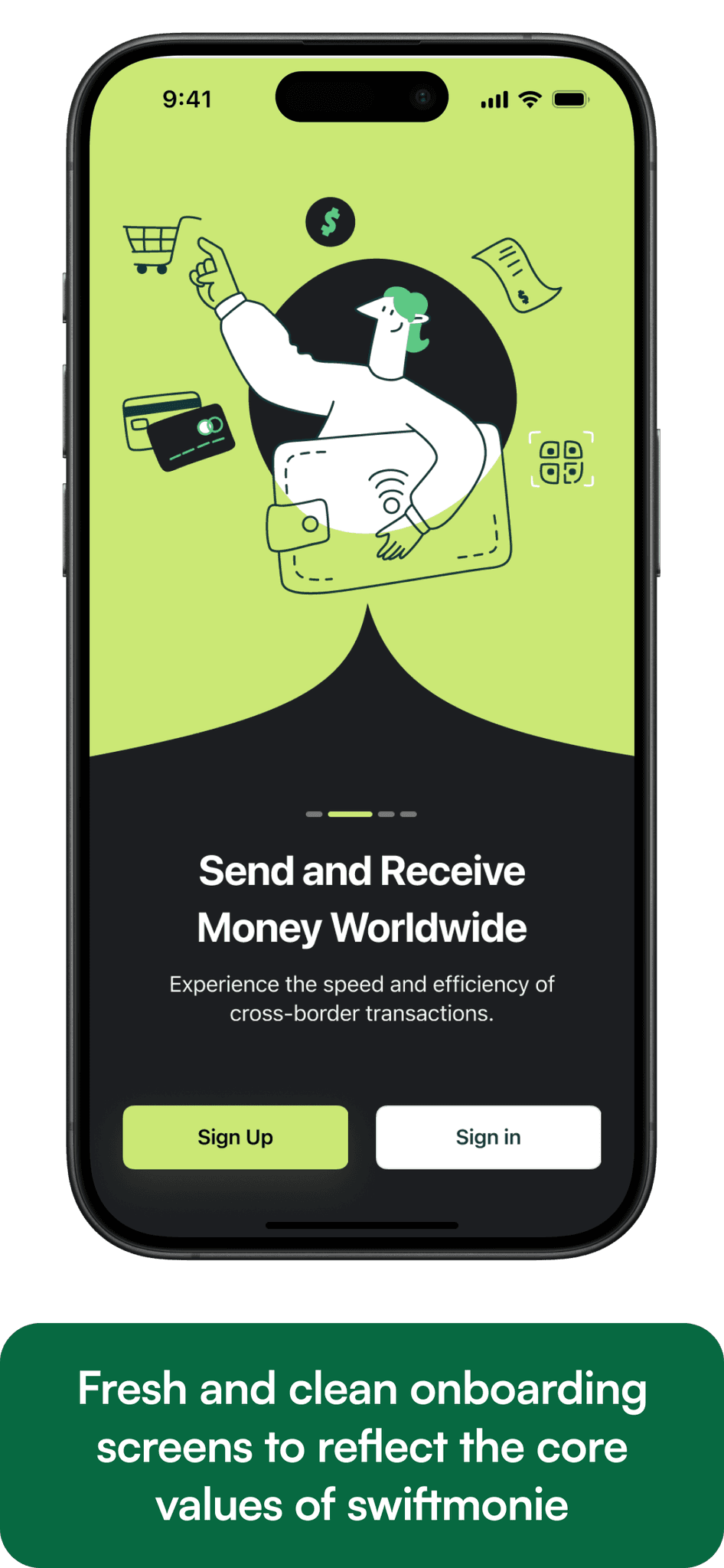

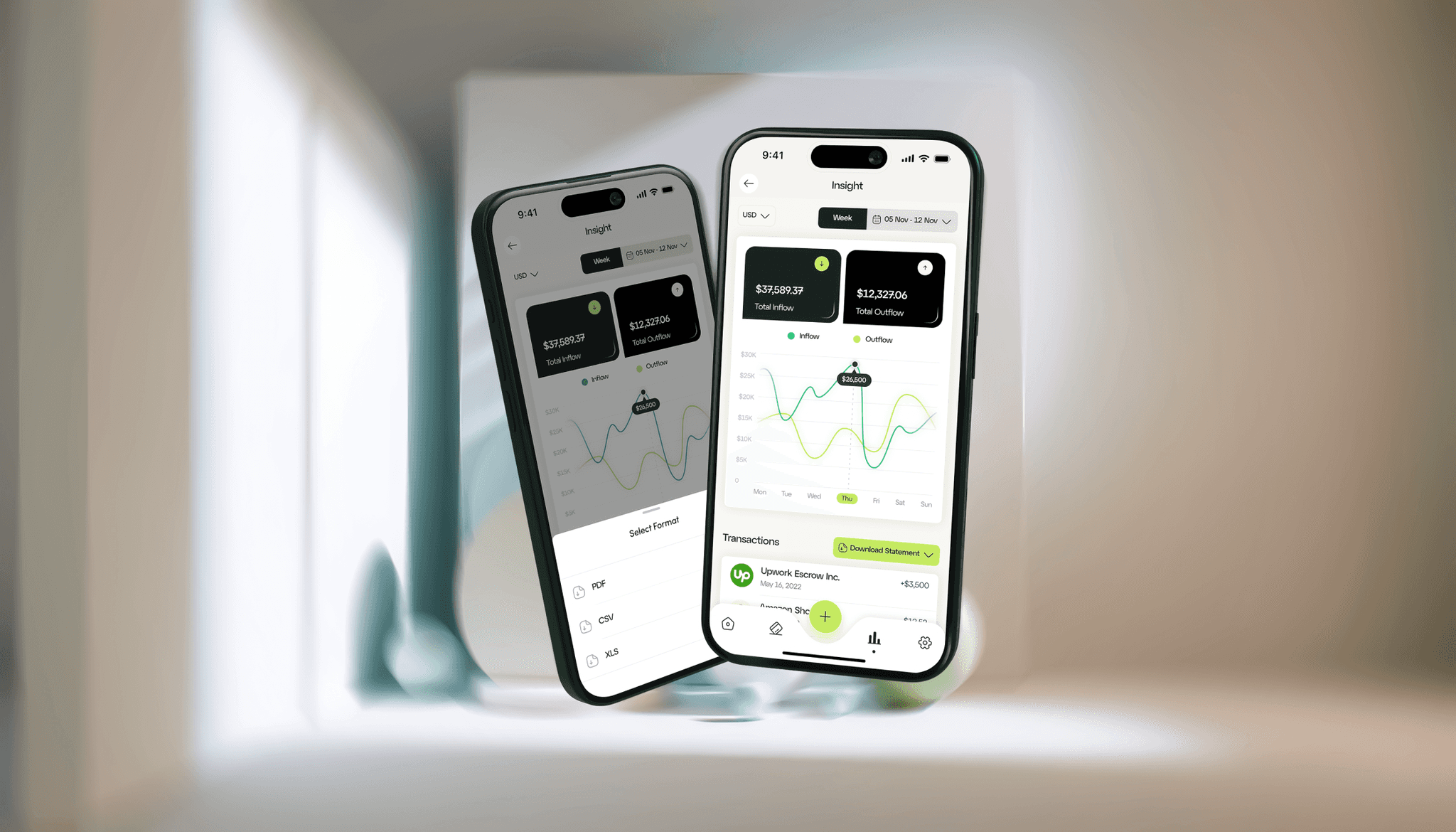

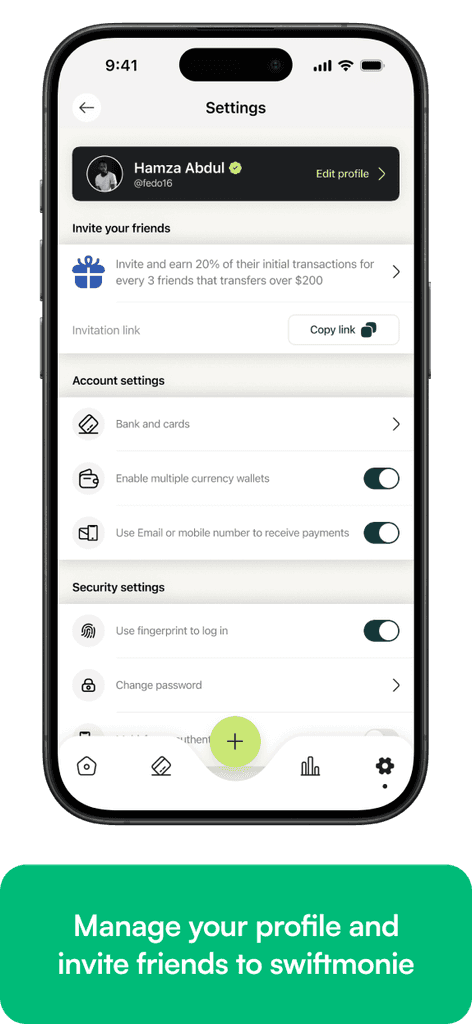

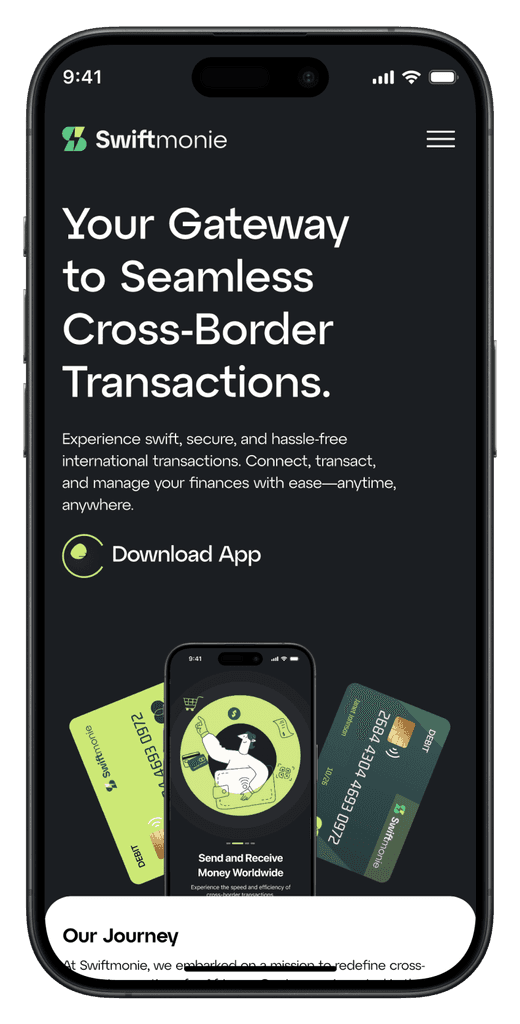

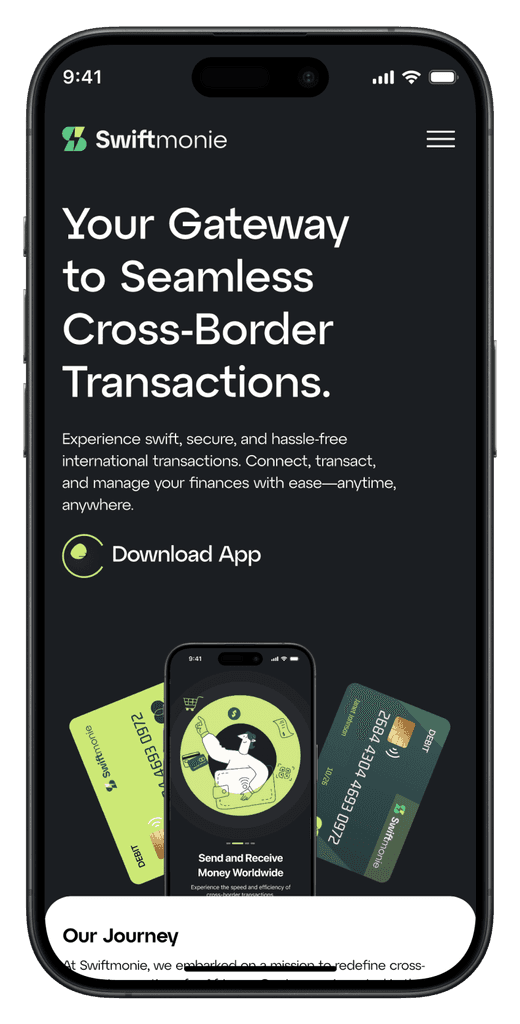

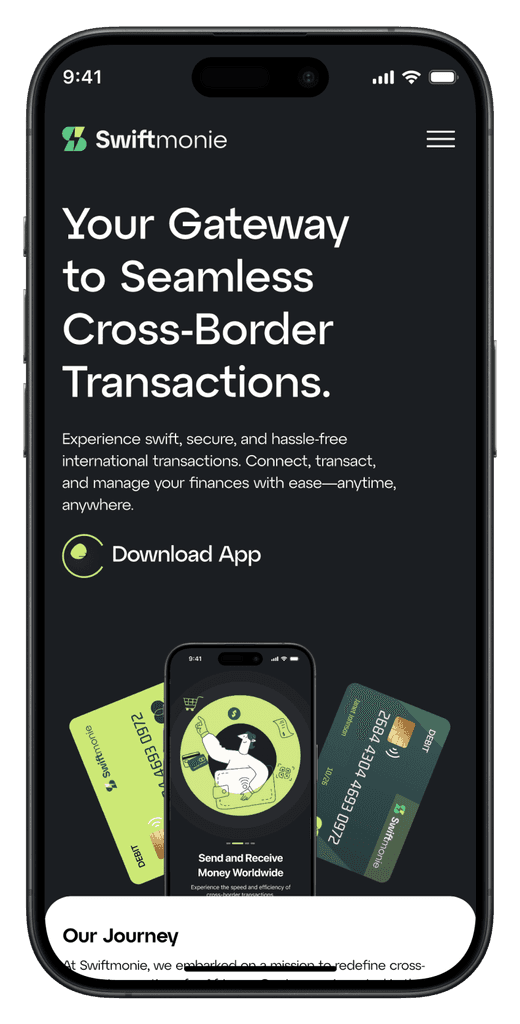

Swiftmonie - A scale to financial freedom for Africans

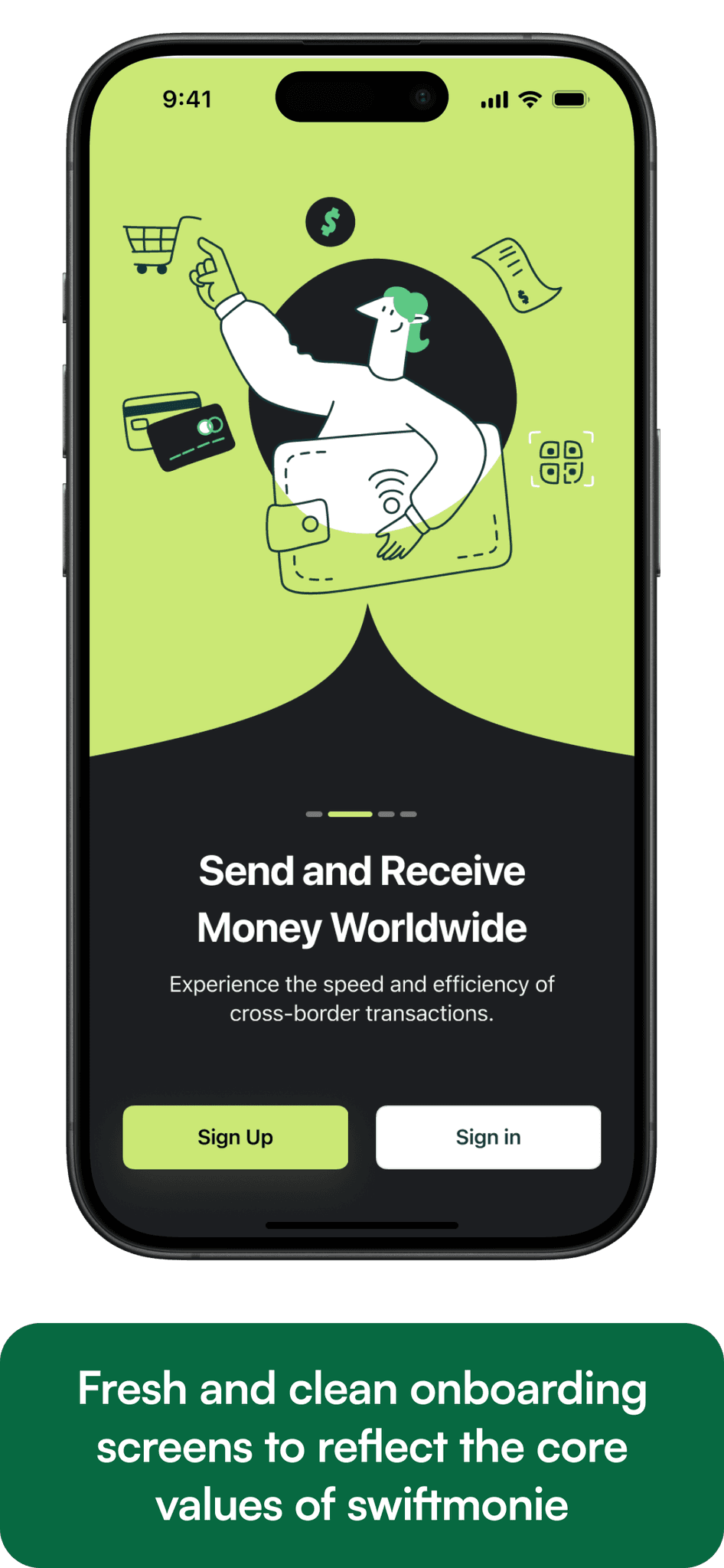

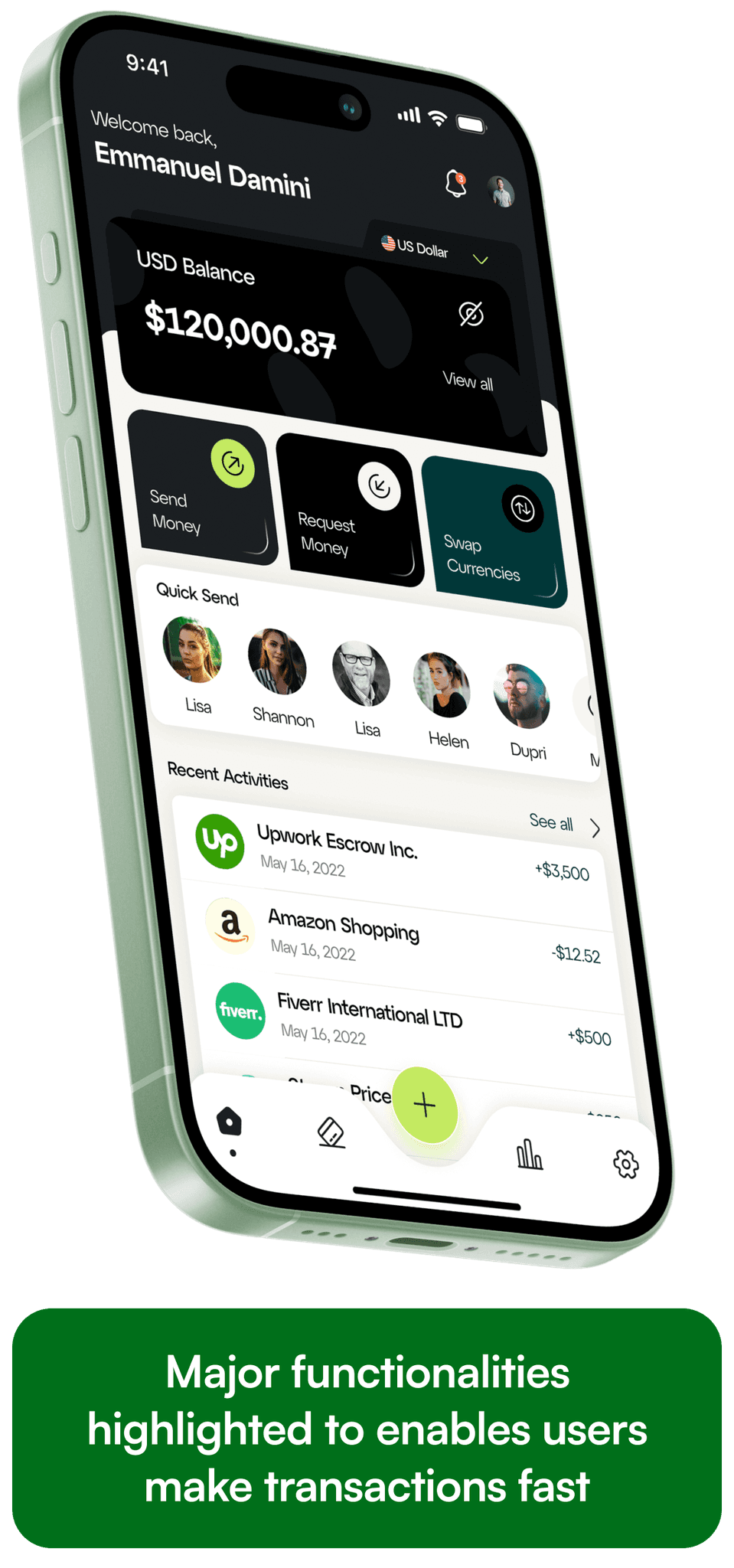

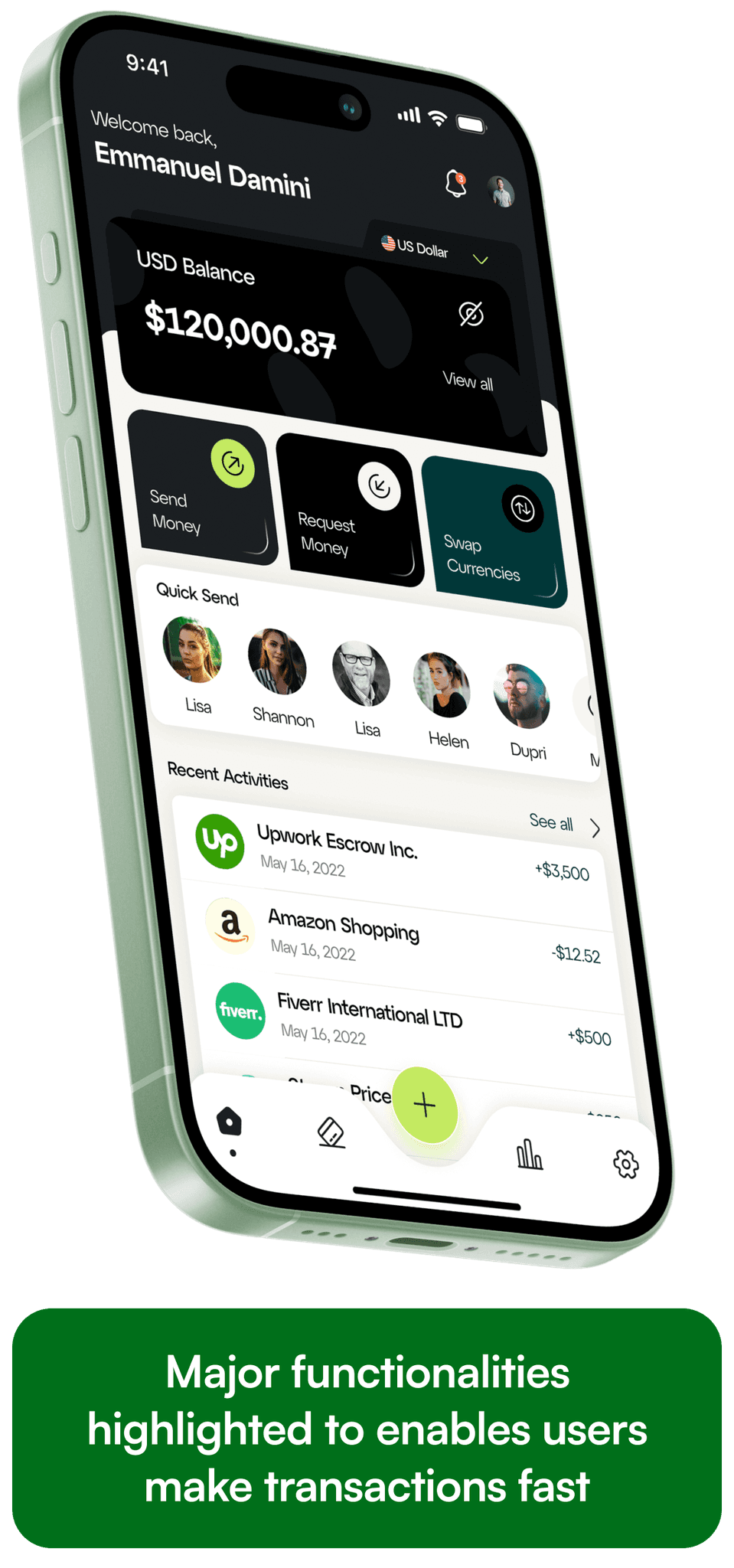

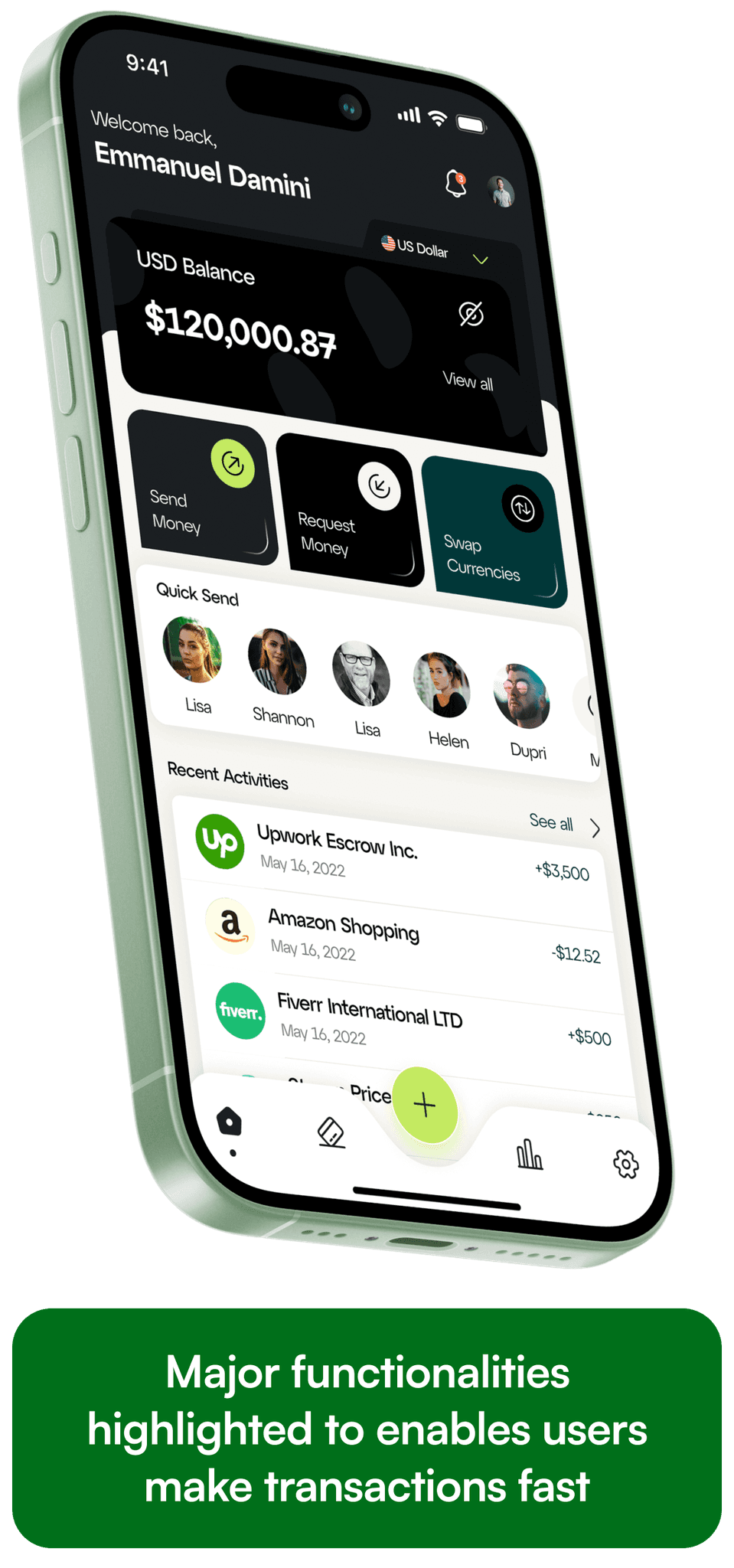

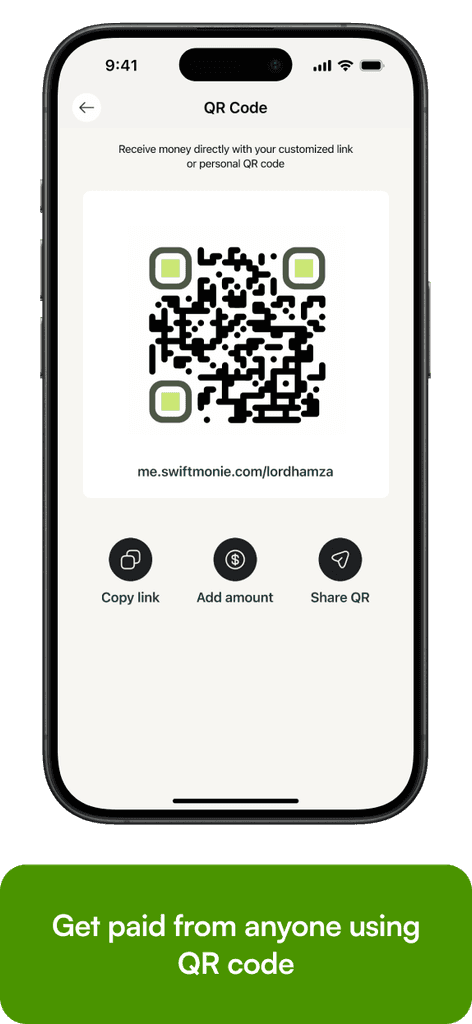

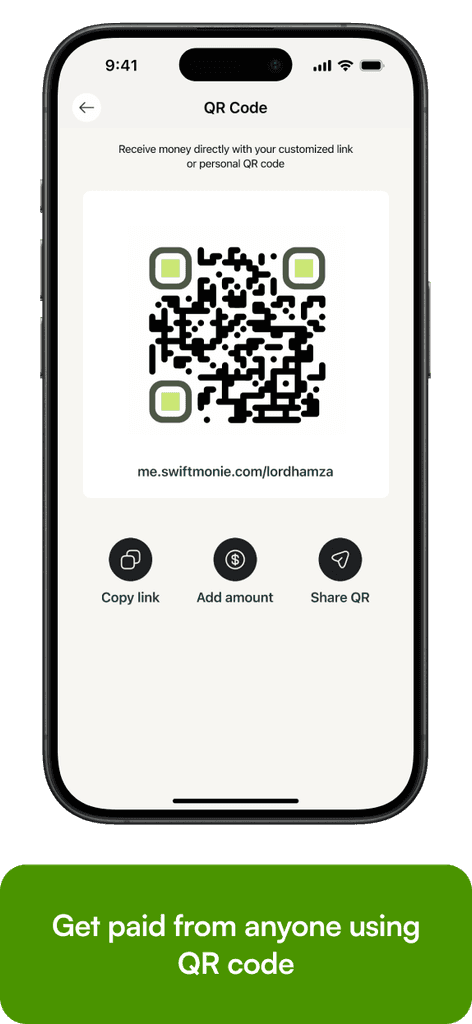

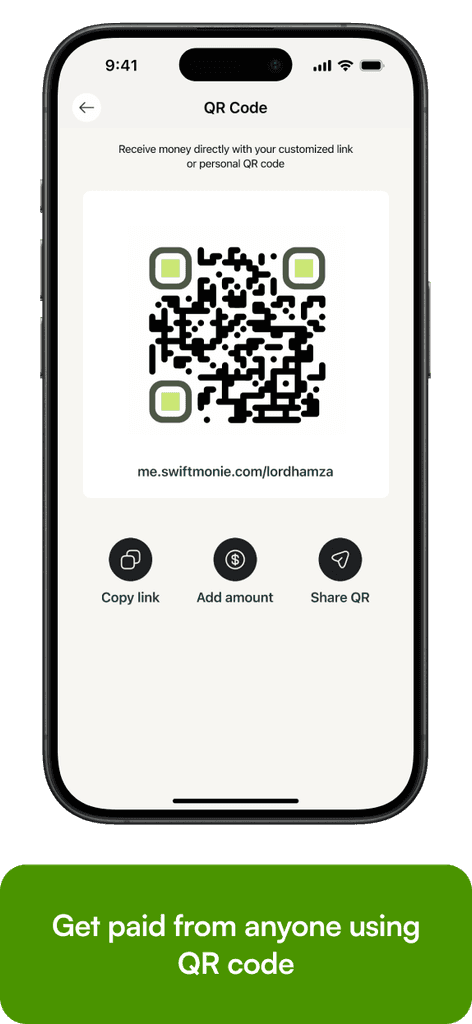

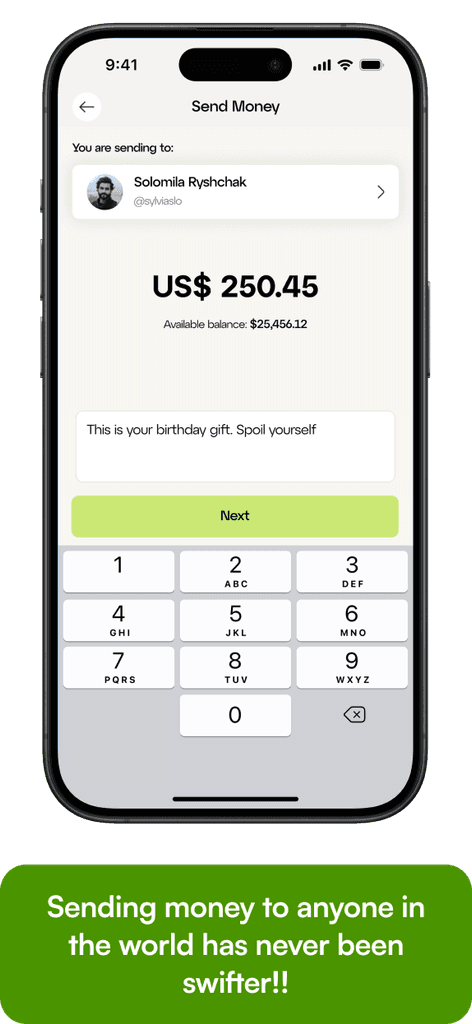

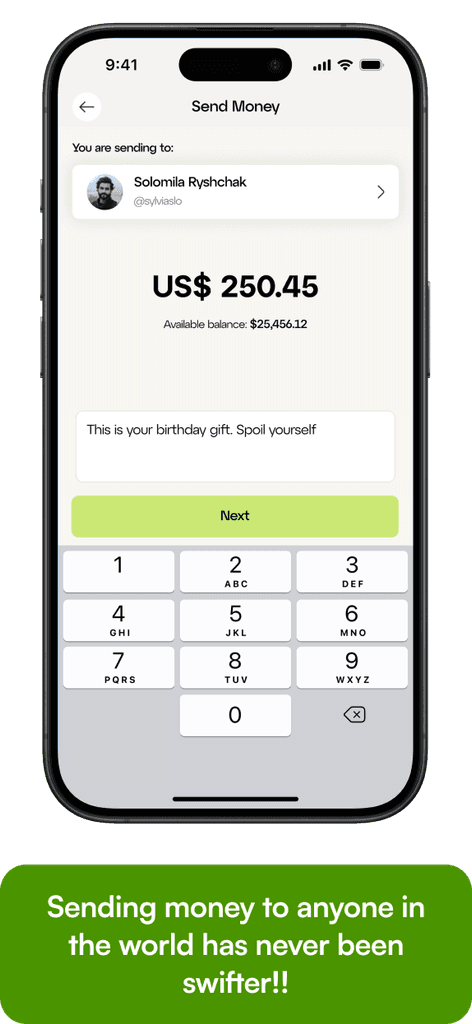

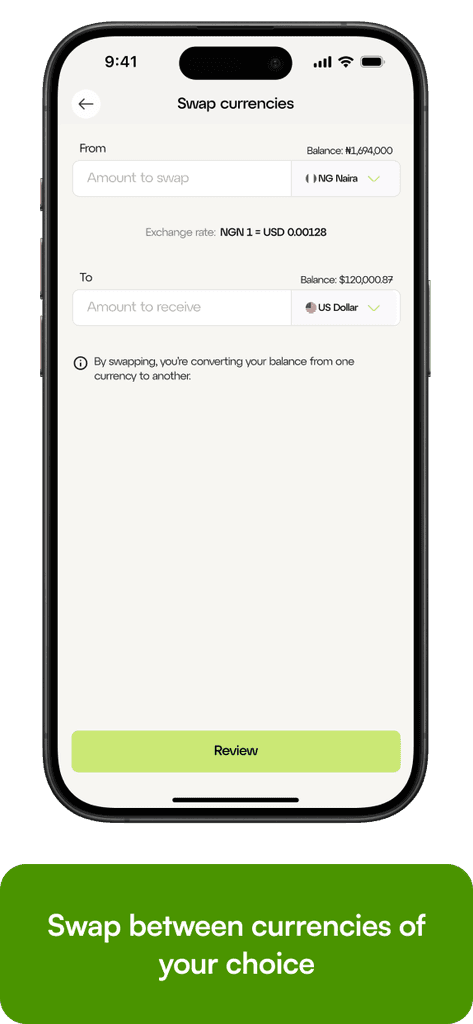

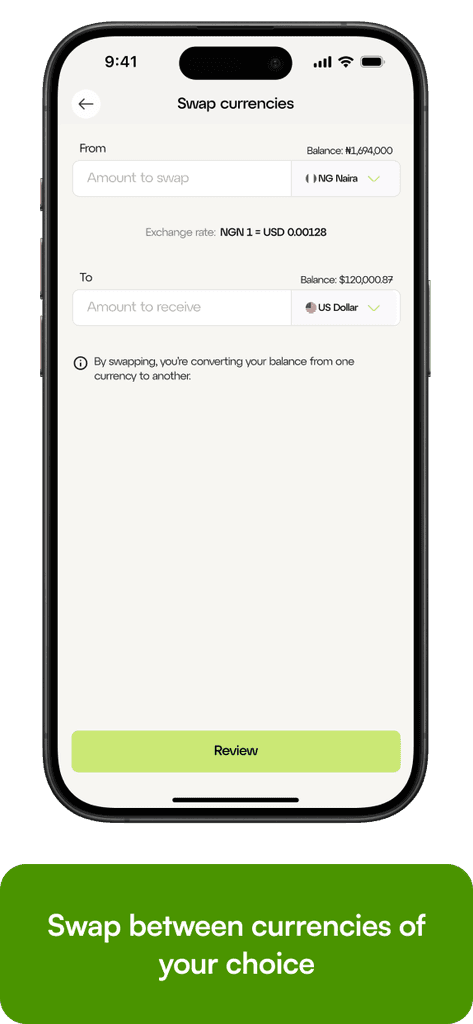

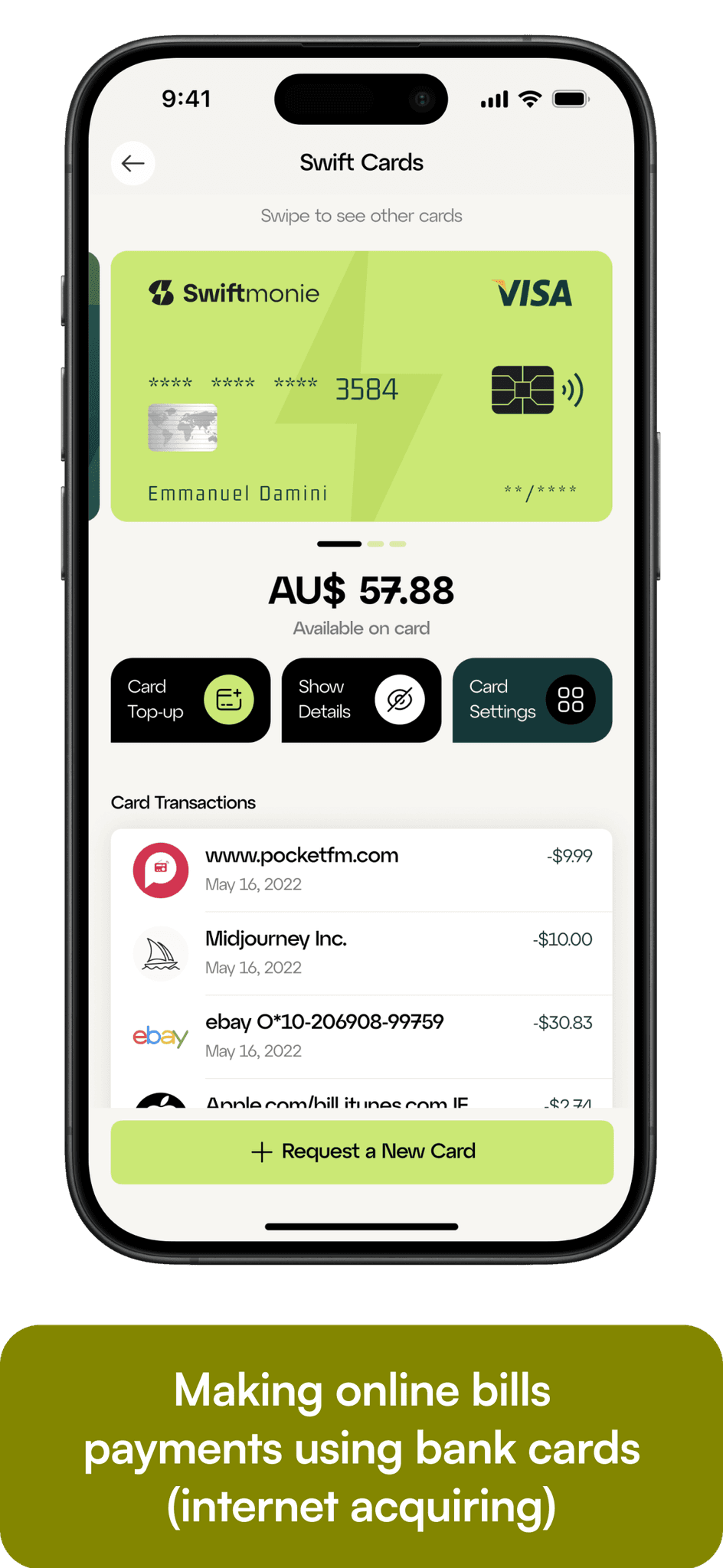

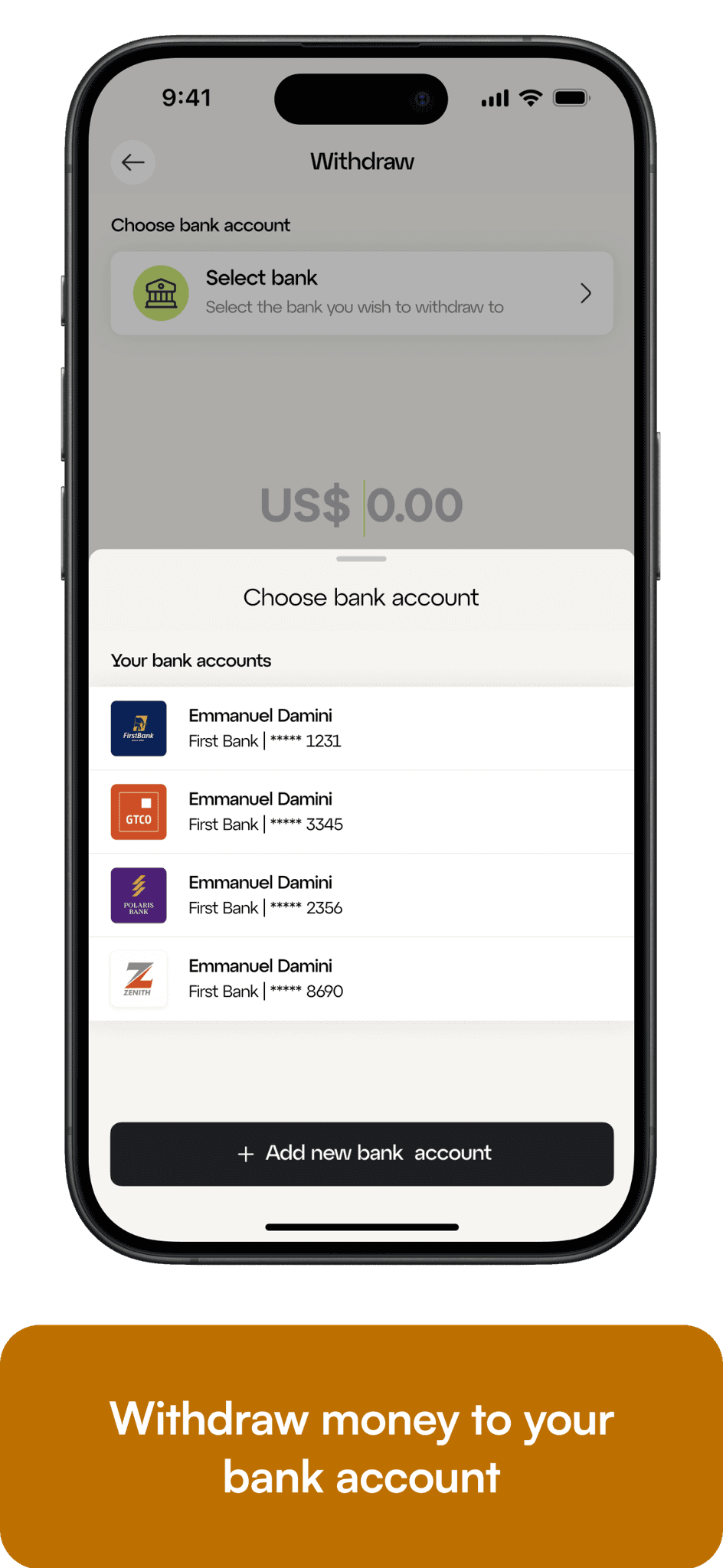

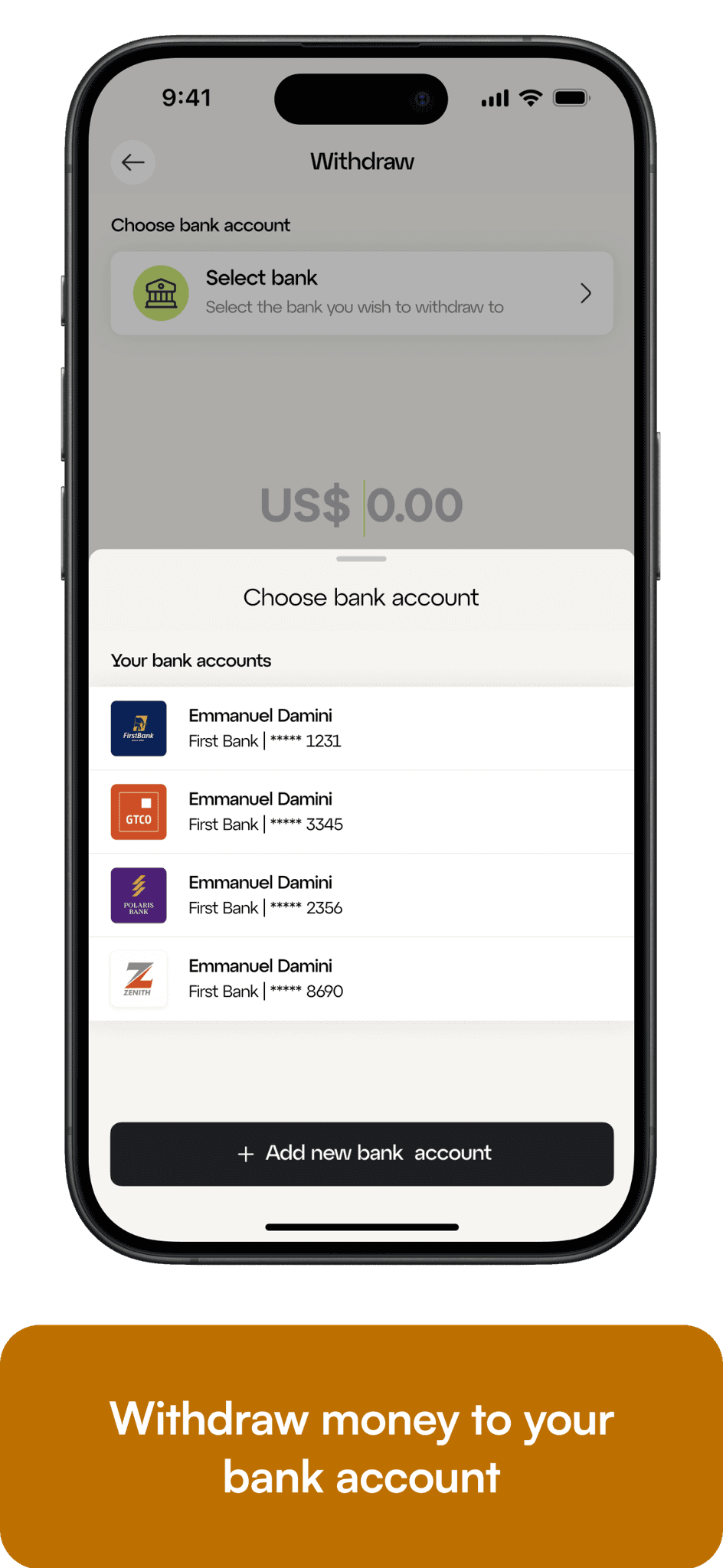

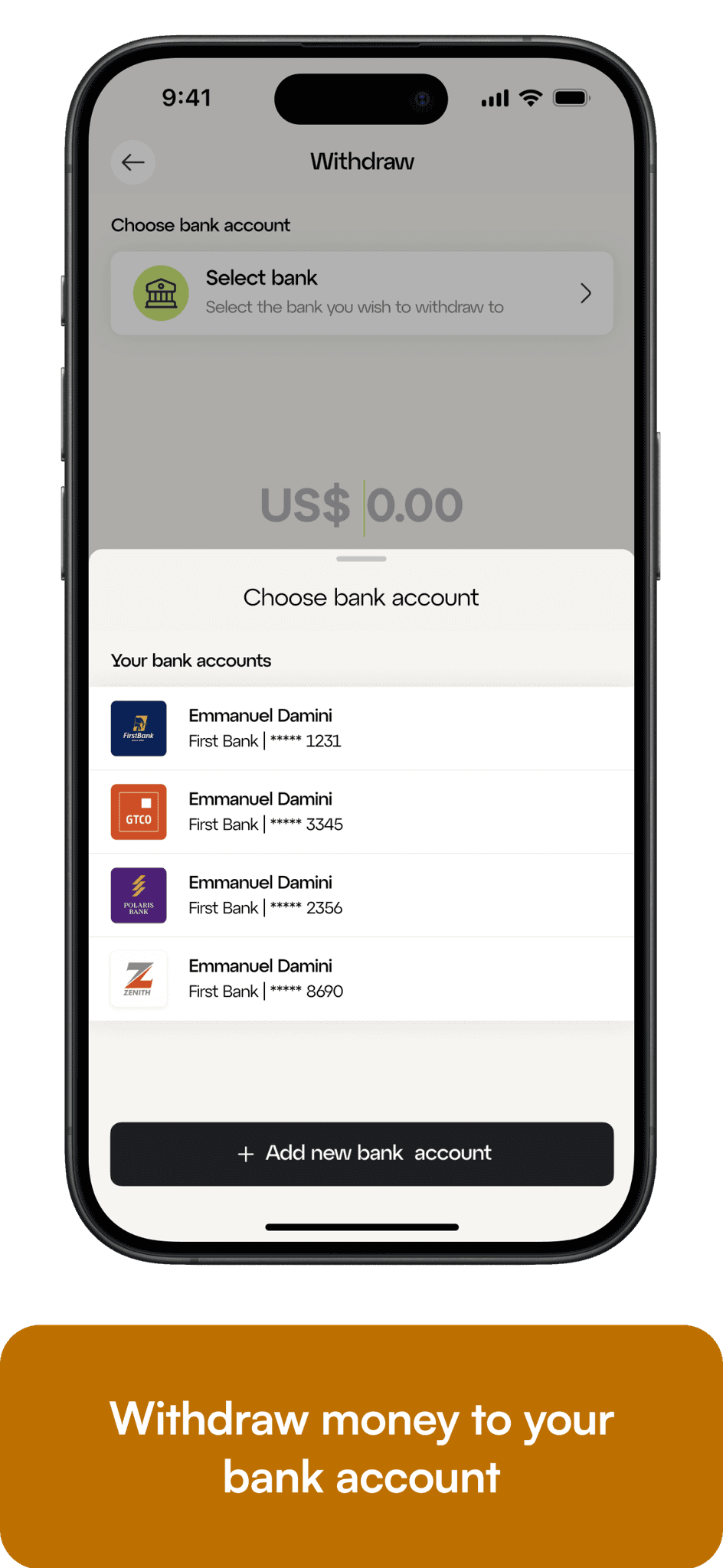

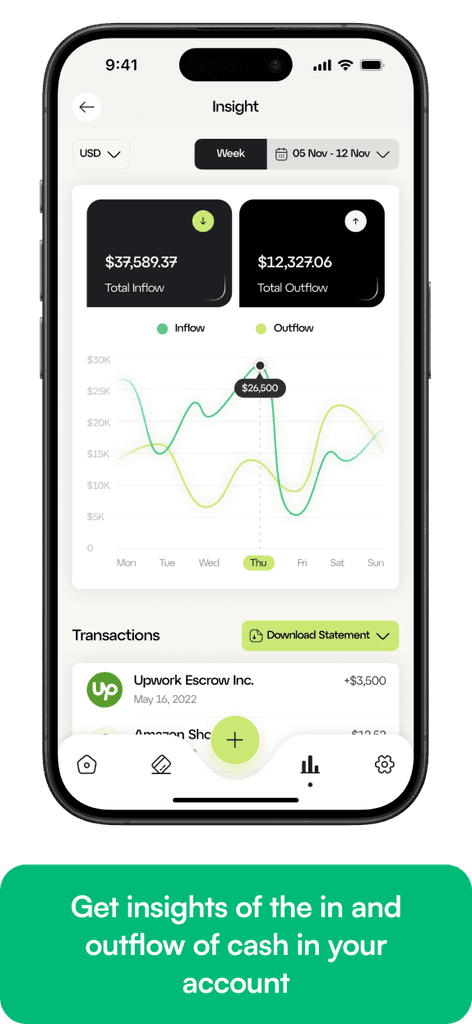

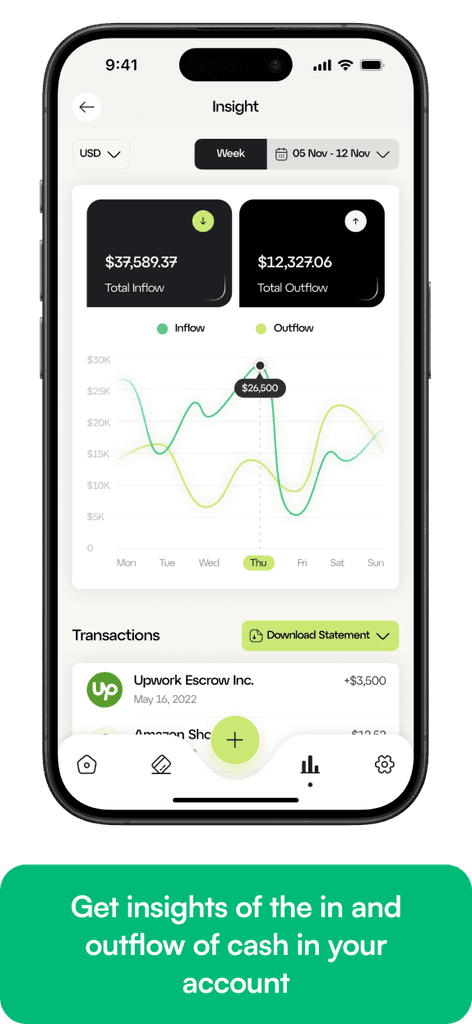

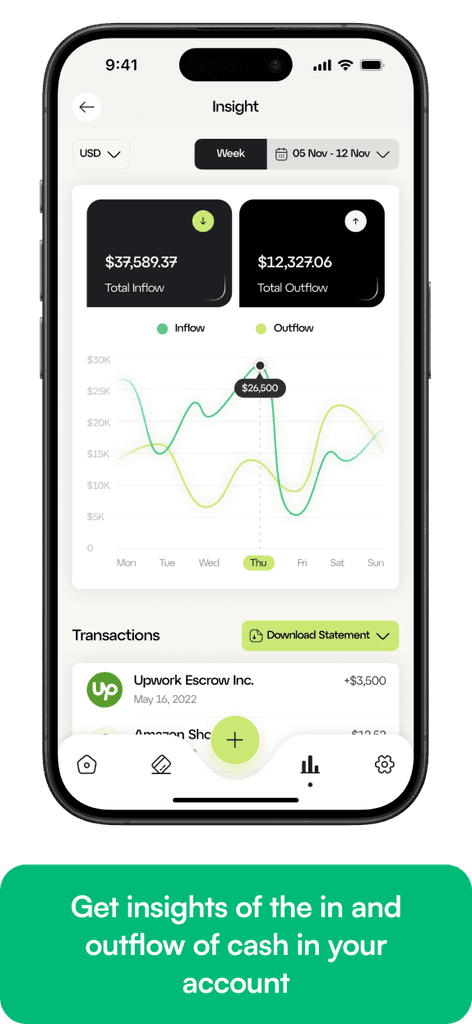

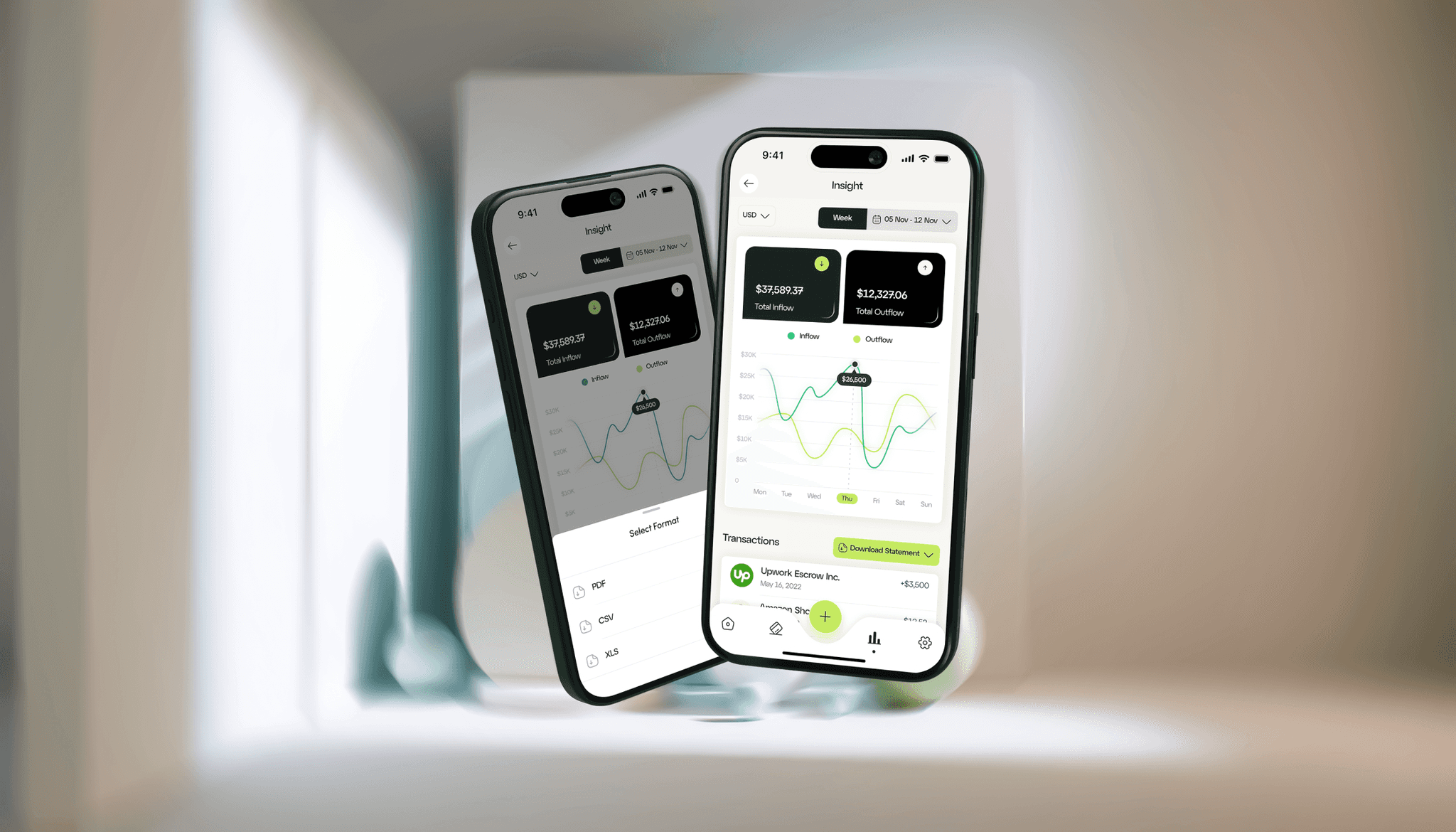

Providing a quick and easy way for users to receive funds, swap the funds into their local currency then withdraw to their local bank accounts

Mobile App

Fintech

Website page

Overview and challenge!!

In an era marked by the rapid embrace of remote work and digital transactions, a significant hurdle hampers the financial connectivity of Africans on the global stage. Existing platforms, including major players like Paypal, impose limitations that hinder the seamless cross-border flow of funds.

This challenge is particularly pronounced for freelancers in Africa, who often face isolation due to restrictions and bans. Swiftmonie steps in as a comprehensive fintech solution, dedicated to empowering individuals and businesses across the African continent.

Concept & approach

Swiftmonie is looking to help individuals recieve cross-border payments, convert it to their local currency and withdraw the funds to their local bank accounts quickly and fast.

Our mission is to unlock financial opportunities, strengthen economic ties, and foster a connected and prosperous future for the diverse communities of Africa in the evolving landscape of digital finance."

The idea is to make the experience simple, easy to understand, no hidden fees or surprises by working with financial institutions across the world to enable users receive currencies into their wallet by creating unique bank accounts for each user.

The research

In the beginning, it was a personal pain point of myself and the team. After conversing with several colleagues we realized that in order to make a successful product, we would need to interview other freelancers like us that may benefit from this solution.

This included freelancers in different industries and niches across Africa. Our interviews were mainly centered around:

“ How they currently received funds from clients abroad ”

“ Challenges they faced when trying to get their funds ”

“ Their ideal/preferred ways of receiving funds ”

Key findings:

80% of the interviewees currently use payoneer and cryptocurrency

85% of them complained of high transaction charges and high fluctuations in crypto.

65% of them suggested that most clients do not like using cryptocurrency

80% of them preferred to have a single platform handle cash request, swap and withdrawal.

The research was quite extensive, Check the full research here

What I learnt

Working on this project gave me insight on the intricacies involved in building a fintech application. One of the major aspect of this was when I wanted to choose API’s that will work for each use cases.

Thanks for reading!!

Check out more exciting projects

Here's what people say about me

Hamza designed our SaaS product with enthusiasm, professionalism, and a strong grasp of UI/UX. He delivered on time and exceeded expectations. Wishing him all the best ahead!

Abhishek Srivastava

CEO LabSmart Healthcare Technologies

Hamza is a top-notch UI/UX designer with a high creativity level and a discipline to fulfill tasks in required time! If you’re looking for a freelancer to do a great job in required time, Hamza is your guy!

Mattew Oji

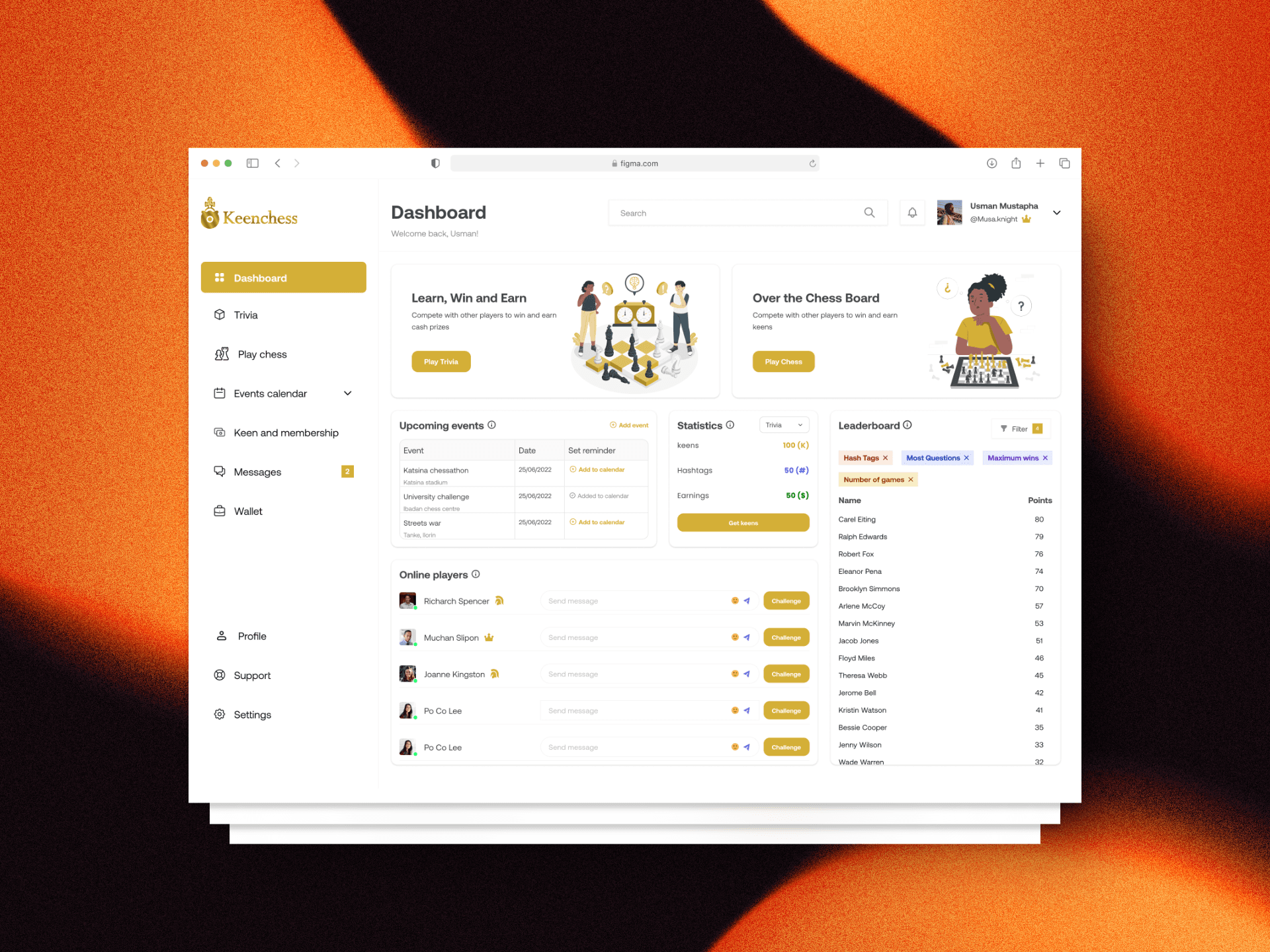

Chess Ethuisiast, CEO KeenChess INC

Hamza is a top, top designer with unbelievable eyes for details, his impact showed from the moment he joined my team at keenchess. I highly recommend you give him a chance to help build your product.

Frank Egwu

Co-founder KeenChess Inc

Yes, I’d highly recommend Hamza as he’s really patient with one, he carries one along at every step of a work, criticize and at the same time encourages professionally.

Tayo O. Oreoluwa

Product designer

Oh yes!, he is a professional and we've worked together on a product , his inputs and contributions was very helpful in shaping the direction of the project!

Einstein G. Oyakhilome

Freelance, Product designer

Hamza is a great team player, skilled at his job, He will do all it takes to contribute the best to the team and project at hand. He is a great designer, and he is a continuous learner, he doesn’t stop until the best is achieved.

Lizzy Dahunsi

Design manager

Hamza did an outstanding job on my portfolio! The design was creative, user-friendly, and visually polished. I highly recommend his services!

Olaiya basit

Software Engineer, Wazobia technologies.

Hamza designed our SaaS product with enthusiasm, professionalism, and a strong grasp of UI/UX. He delivered on time and exceeded expectations. Wishing him all the best ahead!

Abhishek Srivastava

CEO LabSmart Healthcare Technologies

Hamza is a top-notch UI/UX designer with a high creativity level and a discipline to fulfill tasks in required time! If you’re looking for a freelancer to do a great job in required time, Hamza is your guy!

Mattew Oji

Chess Ethuisiast, CEO KeenChess INC

Hamza is a top, top designer with unbelievable eyes for details, his impact showed from the moment he joined my team at keenchess. I highly recommend you give him a chance to help build your product.

Frank Egwu

Co-founder KeenChess Inc

Yes, I’d highly recommend Hamza as he’s really patient with one, he carries one along at every step of a work, criticize and at the same time encourages professionally.

Tayo O. Oreoluwa

Product designer

Oh yes!, he is a professional and we've worked together on a product , his inputs and contributions was very helpful in shaping the direction of the project!

Einstein G. Oyakhilome

Freelance, Product designer

Hamza is a great team player, skilled at his job, He will do all it takes to contribute the best to the team and project at hand. He is a great designer, and he is a continuous learner, he doesn’t stop until the best is achieved.

Lizzy Dahunsi

Design manager

Hamza did an outstanding job on my portfolio! The design was creative, user-friendly, and visually polished. I highly recommend his services!

Olaiya basit

Software Engineer, Wazobia technologies.

Hamza designed our SaaS product with enthusiasm, professionalism, and a strong grasp of UI/UX. He delivered on time and exceeded expectations. Wishing him all the best ahead!

Abhishek Srivastava

CEO LabSmart Healthcare Technologies

Hamza is a top-notch UI/UX designer with a high creativity level and a discipline to fulfill tasks in required time! If you’re looking for a freelancer to do a great job in required time, Hamza is your guy!

Mattew Oji

Chess Ethuisiast, CEO KeenChess INC

Hamza is a top, top designer with unbelievable eyes for details, his impact showed from the moment he joined my team at keenchess. I highly recommend you give him a chance to help build your product.

Frank Egwu

Co-founder KeenChess Inc

Yes, I’d highly recommend Hamza as he’s really patient with one, he carries one along at every step of a work, criticize and at the same time encourages professionally.

Tayo O. Oreoluwa

Product designer

Oh yes!, he is a professional and we've worked together on a product , his inputs and contributions was very helpful in shaping the direction of the project!

Einstein G. Oyakhilome

Freelance, Product designer

Hamza is a great team player, skilled at his job, He will do all it takes to contribute the best to the team and project at hand. He is a great designer, and he is a continuous learner, he doesn’t stop until the best is achieved.

Lizzy Dahunsi

Design manager

Hamza did an outstanding job on my portfolio! The design was creative, user-friendly, and visually polished. I highly recommend his services!

Olaiya basit

Software Engineer, Wazobia technologies.

Hamza designed our SaaS product with enthusiasm, professionalism, and a strong grasp of UI/UX. He delivered on time and exceeded expectations. Wishing him all the best ahead!

Abhishek Srivastava

CEO LabSmart Healthcare Technologies

Hamza is a top-notch UI/UX designer with a high creativity level and a discipline to fulfill tasks in required time! If you’re looking for a freelancer to do a great job in required time, Hamza is your guy!

Mattew Oji

Chess Ethuisiast, CEO KeenChess INC

Hamza is a top, top designer with unbelievable eyes for details, his impact showed from the moment he joined my team at keenchess. I highly recommend you give him a chance to help build your product.

Frank Egwu

Co-founder KeenChess Inc

Yes, I’d highly recommend Hamza as he’s really patient with one, he carries one along at every step of a work, criticize and at the same time encourages professionally.

Tayo O. Oreoluwa

Product designer

Oh yes!, he is a professional and we've worked together on a product , his inputs and contributions was very helpful in shaping the direction of the project!

Einstein G. Oyakhilome

Freelance, Product designer

Hamza is a great team player, skilled at his job, He will do all it takes to contribute the best to the team and project at hand. He is a great designer, and he is a continuous learner, he doesn’t stop until the best is achieved.

Lizzy Dahunsi

Design manager

Hamza did an outstanding job on my portfolio! The design was creative, user-friendly, and visually polished. I highly recommend his services!

Olaiya basit

Software Engineer, Wazobia technologies.

Hamza designed our SaaS product with enthusiasm, professionalism, and a strong grasp of UI/UX. He delivered on time and exceeded expectations. Wishing him all the best ahead!

Abhishek Srivastava

CEO LabSmart Healthcare Technologies

Hamza is a top-notch UI/UX designer with a high creativity level and a discipline to fulfill tasks in required time! If you’re looking for a freelancer to do a great job in required time, Hamza is your guy!

Mattew Oji

Chess Ethuisiast, CEO KeenChess INC

Hamza is a top, top designer with unbelievable eyes for details, his impact showed from the moment he joined my team at keenchess. I highly recommend you give him a chance to help build your product.

Frank Egwu

Co-founder KeenChess Inc

Yes, I’d highly recommend Hamza as he’s really patient with one, he carries one along at every step of a work, criticize and at the same time encourages professionally.

Tayo O. Oreoluwa

Product designer

Oh yes!, he is a professional and we've worked together on a product , his inputs and contributions was very helpful in shaping the direction of the project!

Einstein G. Oyakhilome

Freelance, Product designer

Hamza is a great team player, skilled at his job, He will do all it takes to contribute the best to the team and project at hand. He is a great designer, and he is a continuous learner, he doesn’t stop until the best is achieved.

Lizzy Dahunsi

Design manager

Hamza did an outstanding job on my portfolio! The design was creative, user-friendly, and visually polished. I highly recommend his services!

Olaiya basit

Software Engineer, Wazobia technologies.

Hamza designed our SaaS product with enthusiasm, professionalism, and a strong grasp of UI/UX. He delivered on time and exceeded expectations. Wishing him all the best ahead!

Abhishek Srivastava

CEO LabSmart Healthcare Technologies

Hamza is a top-notch UI/UX designer with a high creativity level and a discipline to fulfill tasks in required time! If you’re looking for a freelancer to do a great job in required time, Hamza is your guy!

Mattew Oji

Chess Ethuisiast, CEO KeenChess INC

Hamza is a top, top designer with unbelievable eyes for details, his impact showed from the moment he joined my team at keenchess. I highly recommend you give him a chance to help build your product.

Frank Egwu

Co-founder KeenChess Inc

Yes, I’d highly recommend Hamza as he’s really patient with one, he carries one along at every step of a work, criticize and at the same time encourages professionally.

Tayo O. Oreoluwa

Product designer

Oh yes!, he is a professional and we've worked together on a product , his inputs and contributions was very helpful in shaping the direction of the project!

Einstein G. Oyakhilome

Freelance, Product designer

Hamza is a great team player, skilled at his job, He will do all it takes to contribute the best to the team and project at hand. He is a great designer, and he is a continuous learner, he doesn’t stop until the best is achieved.

Lizzy Dahunsi

Design manager

Hamza did an outstanding job on my portfolio! The design was creative, user-friendly, and visually polished. I highly recommend his services!

Olaiya basit

Software Engineer, Wazobia technologies.

Hamza designed our SaaS product with enthusiasm, professionalism, and a strong grasp of UI/UX. He delivered on time and exceeded expectations. Wishing him all the best ahead!

Abhishek Srivastava

CEO LabSmart Healthcare Technologies

Hamza is a top-notch UI/UX designer with a high creativity level and a discipline to fulfill tasks in required time! If you’re looking for a freelancer to do a great job in required time, Hamza is your guy!

Mattew Oji

Chess Ethuisiast, CEO KeenChess INC

Hamza is a top, top designer with unbelievable eyes for details, his impact showed from the moment he joined my team at keenchess. I highly recommend you give him a chance to help build your product.

Frank Egwu

Co-founder KeenChess Inc

Yes, I’d highly recommend Hamza as he’s really patient with one, he carries one along at every step of a work, criticize and at the same time encourages professionally.

Tayo O. Oreoluwa

Product designer

Oh yes!, he is a professional and we've worked together on a product , his inputs and contributions was very helpful in shaping the direction of the project!

Einstein G. Oyakhilome

Freelance, Product designer

Hamza is a great team player, skilled at his job, He will do all it takes to contribute the best to the team and project at hand. He is a great designer, and he is a continuous learner, he doesn’t stop until the best is achieved.

Lizzy Dahunsi

Design manager

Hamza did an outstanding job on my portfolio! The design was creative, user-friendly, and visually polished. I highly recommend his services!

Olaiya basit

Software Engineer, Wazobia technologies.

Hamza designed our SaaS product with enthusiasm, professionalism, and a strong grasp of UI/UX. He delivered on time and exceeded expectations. Wishing him all the best ahead!

Abhishek Srivastava

CEO LabSmart Healthcare Technologies

Hamza is a top-notch UI/UX designer with a high creativity level and a discipline to fulfill tasks in required time! If you’re looking for a freelancer to do a great job in required time, Hamza is your guy!

Mattew Oji

Chess Ethuisiast, CEO KeenChess INC

Hamza is a top, top designer with unbelievable eyes for details, his impact showed from the moment he joined my team at keenchess. I highly recommend you give him a chance to help build your product.

Frank Egwu

Co-founder KeenChess Inc

Yes, I’d highly recommend Hamza as he’s really patient with one, he carries one along at every step of a work, criticize and at the same time encourages professionally.

Tayo O. Oreoluwa

Product designer

Oh yes!, he is a professional and we've worked together on a product , his inputs and contributions was very helpful in shaping the direction of the project!

Einstein G. Oyakhilome

Freelance, Product designer

Hamza is a great team player, skilled at his job, He will do all it takes to contribute the best to the team and project at hand. He is a great designer, and he is a continuous learner, he doesn’t stop until the best is achieved.

Lizzy Dahunsi

Design manager

Hamza did an outstanding job on my portfolio! The design was creative, user-friendly, and visually polished. I highly recommend his services!

Olaiya basit

Software Engineer, Wazobia technologies.

Hamza designed our SaaS product with enthusiasm, professionalism, and a strong grasp of UI/UX. He delivered on time and exceeded expectations. Wishing him all the best ahead!

Abhishek Srivastava

CEO LabSmart Healthcare Technologies

Hamza is a top-notch UI/UX designer with a high creativity level and a discipline to fulfill tasks in required time! If you’re looking for a freelancer to do a great job in required time, Hamza is your guy!

Mattew Oji

Chess Ethuisiast, CEO KeenChess INC

Hamza is a top, top designer with unbelievable eyes for details, his impact showed from the moment he joined my team at keenchess. I highly recommend you give him a chance to help build your product.

Frank Egwu

Co-founder KeenChess Inc

Yes, I’d highly recommend Hamza as he’s really patient with one, he carries one along at every step of a work, criticize and at the same time encourages professionally.

Tayo O. Oreoluwa

Product designer

Oh yes!, he is a professional and we've worked together on a product , his inputs and contributions was very helpful in shaping the direction of the project!

Einstein G. Oyakhilome

Freelance, Product designer

Hamza is a great team player, skilled at his job, He will do all it takes to contribute the best to the team and project at hand. He is a great designer, and he is a continuous learner, he doesn’t stop until the best is achieved.

Lizzy Dahunsi

Design manager

Hamza did an outstanding job on my portfolio! The design was creative, user-friendly, and visually polished. I highly recommend his services!

Olaiya basit

Software Engineer, Wazobia technologies.

Hamza designed our SaaS product with enthusiasm, professionalism, and a strong grasp of UI/UX. He delivered on time and exceeded expectations. Wishing him all the best ahead!

Abhishek Srivastava

CEO LabSmart Healthcare Technologies

Hamza is a top-notch UI/UX designer with a high creativity level and a discipline to fulfill tasks in required time! If you’re looking for a freelancer to do a great job in required time, Hamza is your guy!

Mattew Oji

Chess Ethuisiast, CEO KeenChess INC

Hamza is a top, top designer with unbelievable eyes for details, his impact showed from the moment he joined my team at keenchess. I highly recommend you give him a chance to help build your product.

Frank Egwu

Co-founder KeenChess Inc

Yes, I’d highly recommend Hamza as he’s really patient with one, he carries one along at every step of a work, criticize and at the same time encourages professionally.

Tayo O. Oreoluwa

Product designer

Oh yes!, he is a professional and we've worked together on a product , his inputs and contributions was very helpful in shaping the direction of the project!

Einstein G. Oyakhilome

Freelance, Product designer

Hamza is a great team player, skilled at his job, He will do all it takes to contribute the best to the team and project at hand. He is a great designer, and he is a continuous learner, he doesn’t stop until the best is achieved.

Lizzy Dahunsi

Design manager

Hamza did an outstanding job on my portfolio! The design was creative, user-friendly, and visually polished. I highly recommend his services!

Olaiya basit

Software Engineer, Wazobia technologies.

Hamza designed our SaaS product with enthusiasm, professionalism, and a strong grasp of UI/UX. He delivered on time and exceeded expectations. Wishing him all the best ahead!

Abhishek Srivastava

CEO LabSmart Healthcare Technologies

Hamza is a top-notch UI/UX designer with a high creativity level and a discipline to fulfill tasks in required time! If you’re looking for a freelancer to do a great job in required time, Hamza is your guy!

Mattew Oji

Chess Ethuisiast, CEO KeenChess INC

Hamza is a top, top designer with unbelievable eyes for details, his impact showed from the moment he joined my team at keenchess. I highly recommend you give him a chance to help build your product.

Frank Egwu

Co-founder KeenChess Inc

Yes, I’d highly recommend Hamza as he’s really patient with one, he carries one along at every step of a work, criticize and at the same time encourages professionally.

Tayo O. Oreoluwa

Product designer

Oh yes!, he is a professional and we've worked together on a product , his inputs and contributions was very helpful in shaping the direction of the project!

Einstein G. Oyakhilome

Freelance, Product designer

Hamza is a great team player, skilled at his job, He will do all it takes to contribute the best to the team and project at hand. He is a great designer, and he is a continuous learner, he doesn’t stop until the best is achieved.

Lizzy Dahunsi

Design manager

Hamza did an outstanding job on my portfolio! The design was creative, user-friendly, and visually polished. I highly recommend his services!

Olaiya basit

Software Engineer, Wazobia technologies.

Hamza designed our SaaS product with enthusiasm, professionalism, and a strong grasp of UI/UX. He delivered on time and exceeded expectations. Wishing him all the best ahead!

Abhishek Srivastava

CEO LabSmart Healthcare Technologies

Hamza is a top-notch UI/UX designer with a high creativity level and a discipline to fulfill tasks in required time! If you’re looking for a freelancer to do a great job in required time, Hamza is your guy!

Mattew Oji

Chess Ethuisiast, CEO KeenChess INC

Hamza is a top, top designer with unbelievable eyes for details, his impact showed from the moment he joined my team at keenchess. I highly recommend you give him a chance to help build your product.

Frank Egwu

Co-founder KeenChess Inc

Yes, I’d highly recommend Hamza as he’s really patient with one, he carries one along at every step of a work, criticize and at the same time encourages professionally.

Tayo O. Oreoluwa

Product designer

Oh yes!, he is a professional and we've worked together on a product , his inputs and contributions was very helpful in shaping the direction of the project!

Einstein G. Oyakhilome

Freelance, Product designer

Hamza is a great team player, skilled at his job, He will do all it takes to contribute the best to the team and project at hand. He is a great designer, and he is a continuous learner, he doesn’t stop until the best is achieved.

Lizzy Dahunsi

Design manager

Hamza did an outstanding job on my portfolio! The design was creative, user-friendly, and visually polished. I highly recommend his services!

Olaiya basit

Software Engineer, Wazobia technologies.