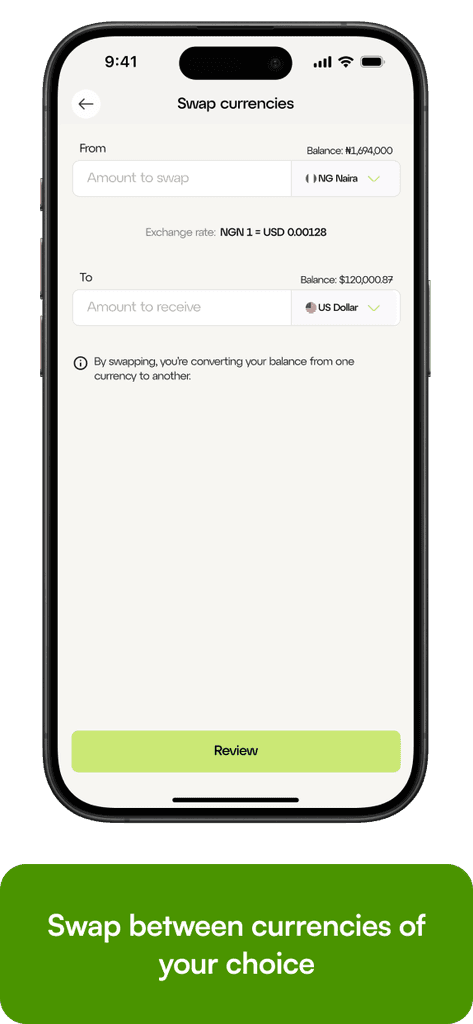

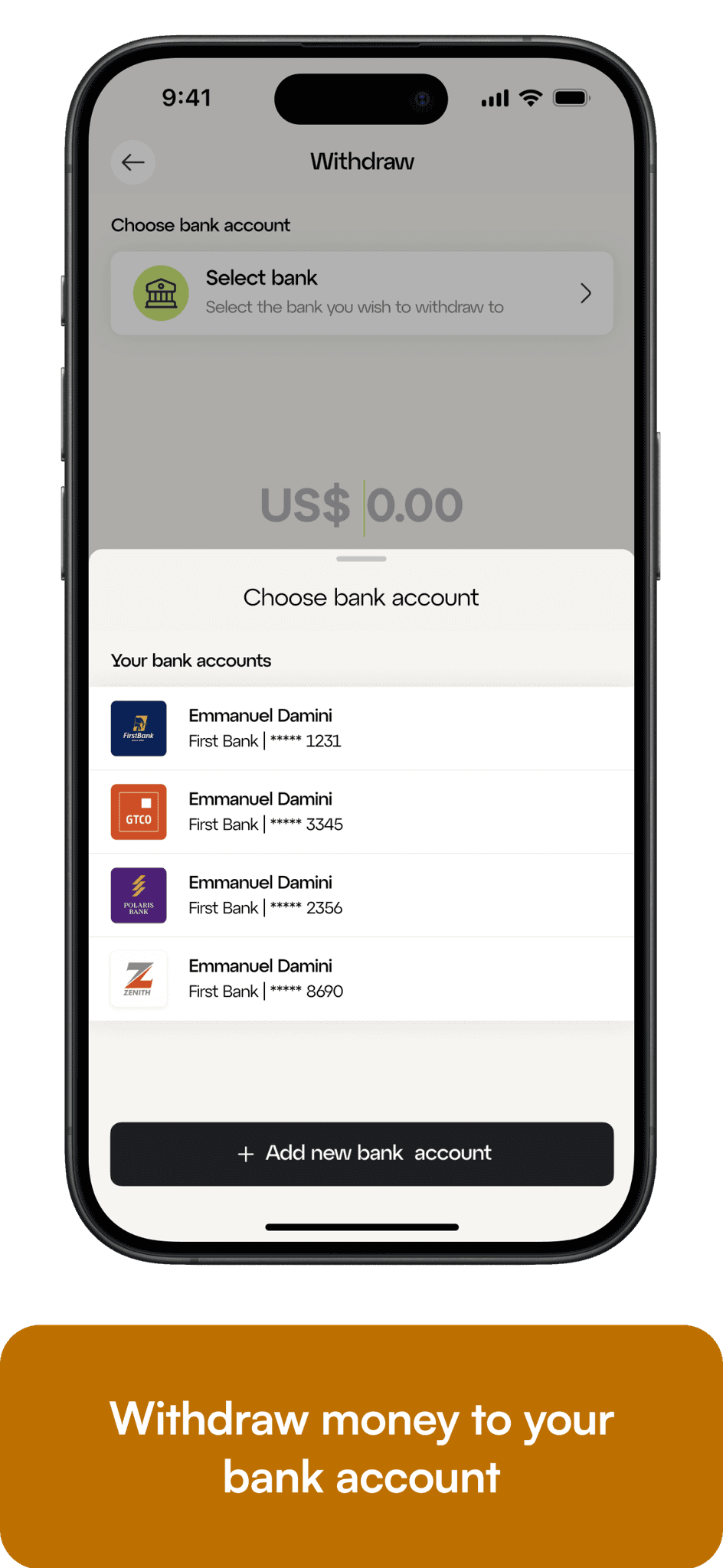

Providing a quick and easy way for users to receive funds, swap the funds into their local currency then withdraw to their local bank accounts

My Role

Lead Designer — Feature Scoping, Research, Interaction Design, Visual Design, Prototyping

Team

Hamza Abdul (Me), UX designer, UX researcher, Framer developer

Oluwasegun Aderibigbe, UX designer, brand & Motion designer

James Balogun, Project manager

Timeline & Status

5 Months, Completed

My Role

I co-founded Swiftmonie with Oluwasegun Aderibigbe because of our shared passion for freelancing and our mutual difficulty in getting a good platform that enables us to receive wages from our clients and convert them to our local currency at fair rates. I managed the entire UI/UX for the web and iOS application.

This project consisted of diving deeply into marketing, user research, iOS design guidelines, web design and usability testing. The majority of my time was spent on ideating with Segun, the engineers, about potential features, focusing on building a minimum viable product for early adopters.

Overview

In an era marked by the rapid embrace of remote work and digital transactions, a significant hurdle hampers the financial connectivity of Africans on the global stage. Existing platforms, including major players like Paypal, impose limitations that hinder the seamless cross-border flow of funds.

This challenge is particularly pronounced for freelancers in Africa, who often face isolation due to restrictions and bans. Swiftmonie steps in as a comprehensive fintech solution, dedicated to empowering individuals and businesses across the African continent.

Concept & approach

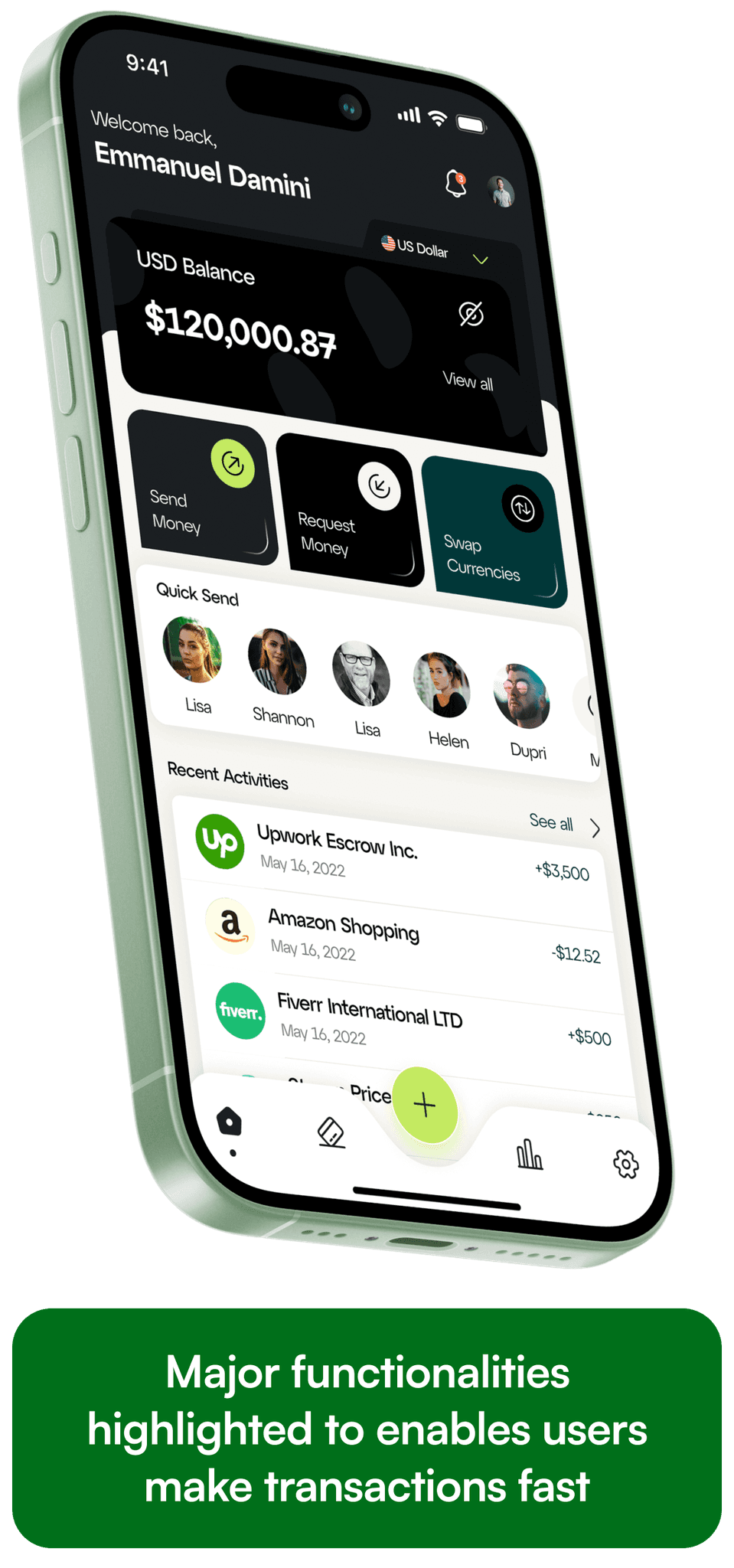

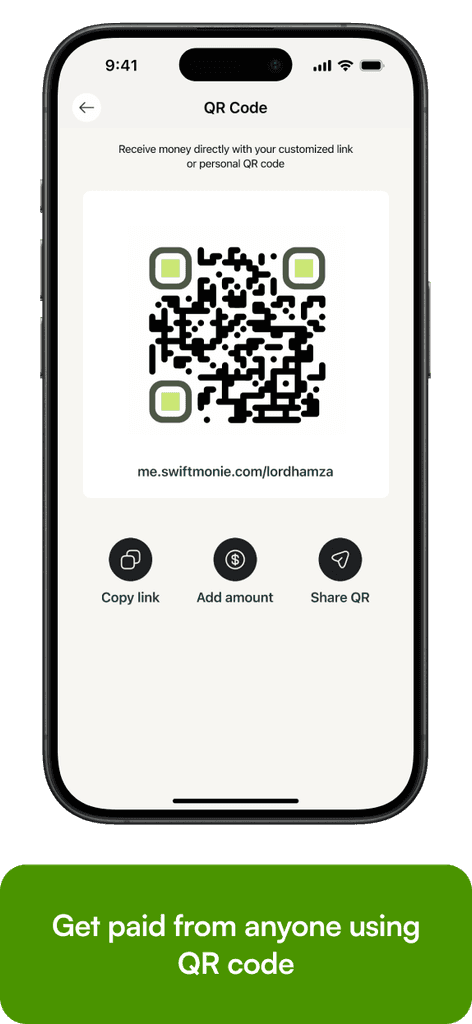

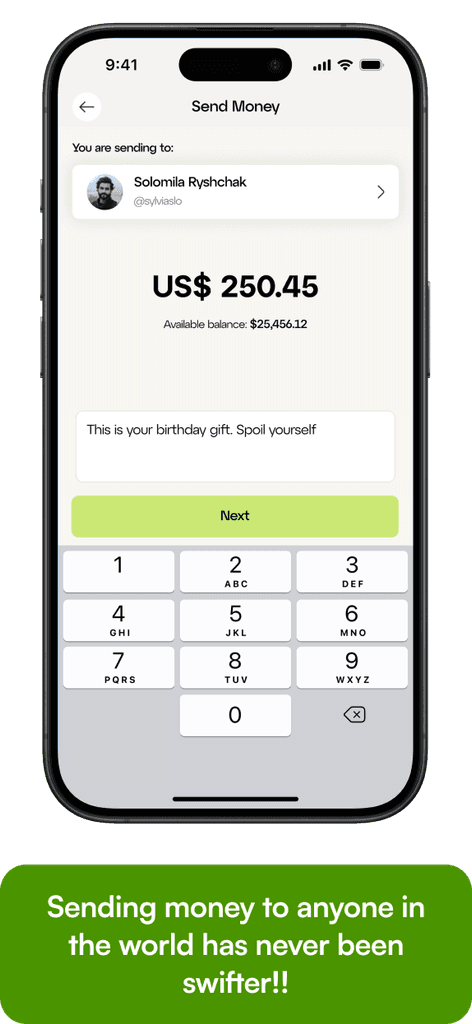

Swiftmonie is looking to help individuals recieve cross-border payments, convert it to their local currency and withdraw the funds to their local bank accounts quickly and fast.

Our mission is to unlock financial opportunities, strengthen economic ties, and foster a connected and prosperous future for the diverse communities of Africa in the evolving landscape of digital finance."

The idea is to make the experience simple, easy to understand, no hidden fees or surprises by working with financial institutions across the world to enable users receive currencies into their wallet by creating unique bank accounts for each user.

The research

In the beginning, it was a personal pain point of myself and the team. After conversing with several colleagues we realized that in order to make a successful product, we would need to interview other freelancers like us that may benefit from this solution.

This included freelancers in different industries and niches across Africa. Our interviews were mainly centered around:

Key findings:

The research was quite extensive, Check the full research here

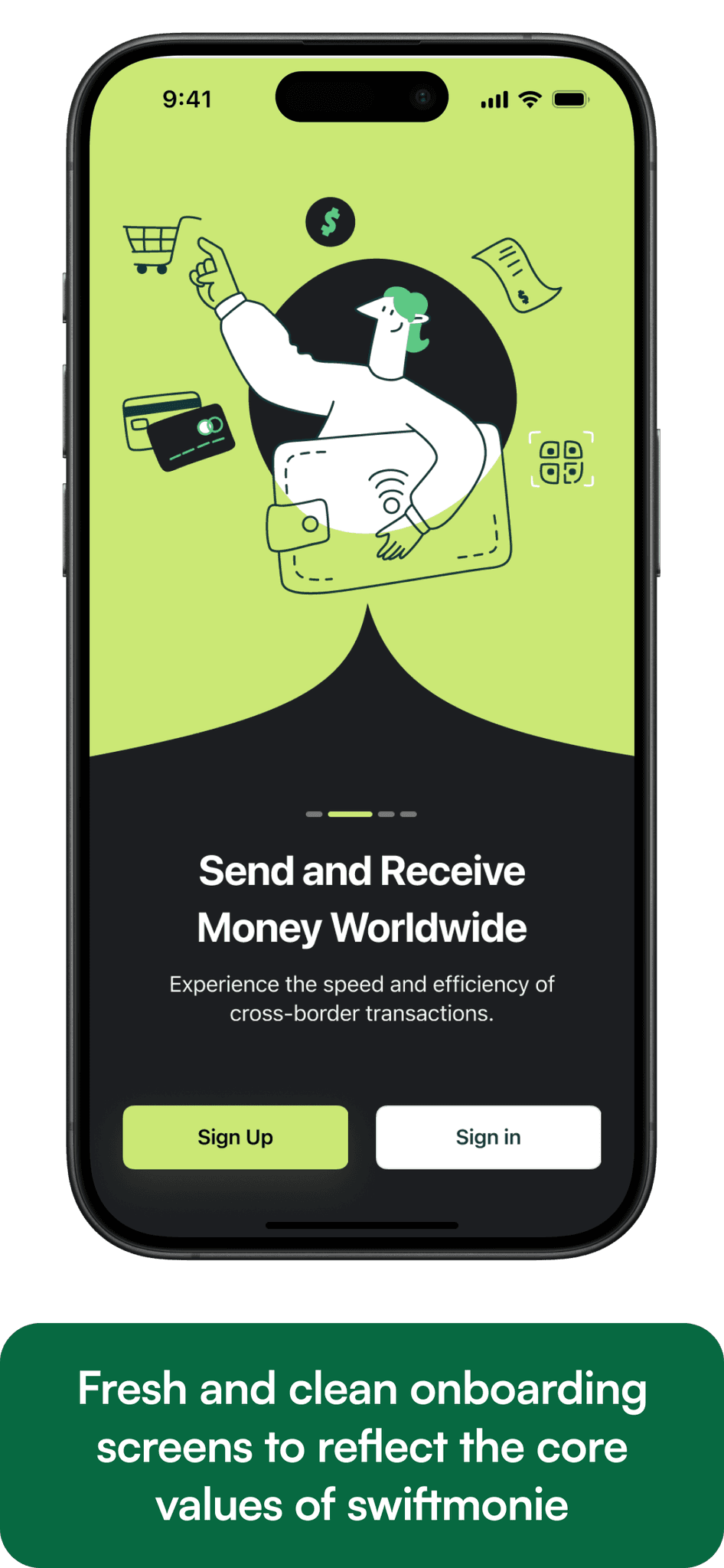

Distinct identity

Swiftmonie's brand identity is meticulously crafted to embody the core values of speed, trust, and global connectivity. The concept centers around a dynamic interplay of elements representing swift and secure financial transactions.

Our approach to branding was user-centric, aiming to resonate with our diverse African audience. We focused on developing a brand that was not only visually appealing but also communicated reliability, innovation, and inclusivity.

The logo, featuring a bold letter 'S' with a lightning bolt at its core, symbolizes the speed and efficiency synonymous with Swiftmonie. The brand voice conveys a commitment to simplicity, transparency, and empowerment.

We chose a unique palette of greens and off-white, stepping away from the traditional blue used by many fintech. The choice of vibrant colors reflects the diversity, energy, and growth inherent in the African continent.

The brand identity seamlessly extends across various touchpoints, creating a cohesive and recognizable presence. From social media graphics to marketing materials, Swiftmonie's brand elements ensure a unified and memorable experience for users.

Whether engaging with freelancers navigating cross-border challenges or individuals seeking financial freedom, Swiftmonie's voice is a guiding companion, making complex financial processes straightforward and accessible.

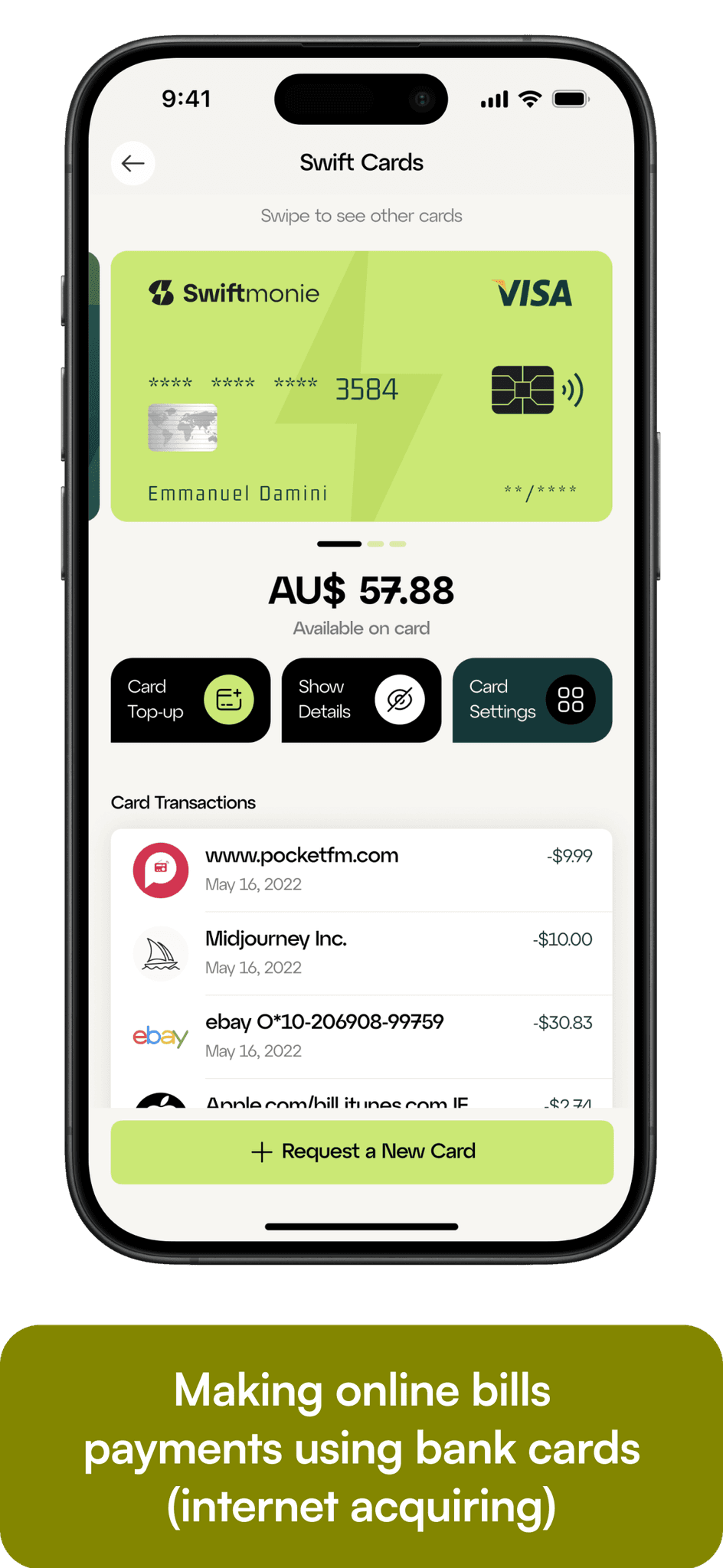

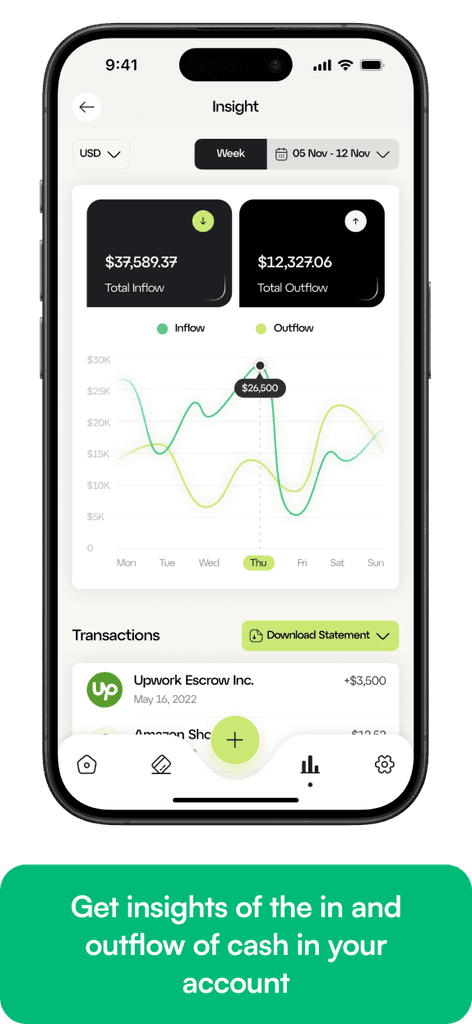

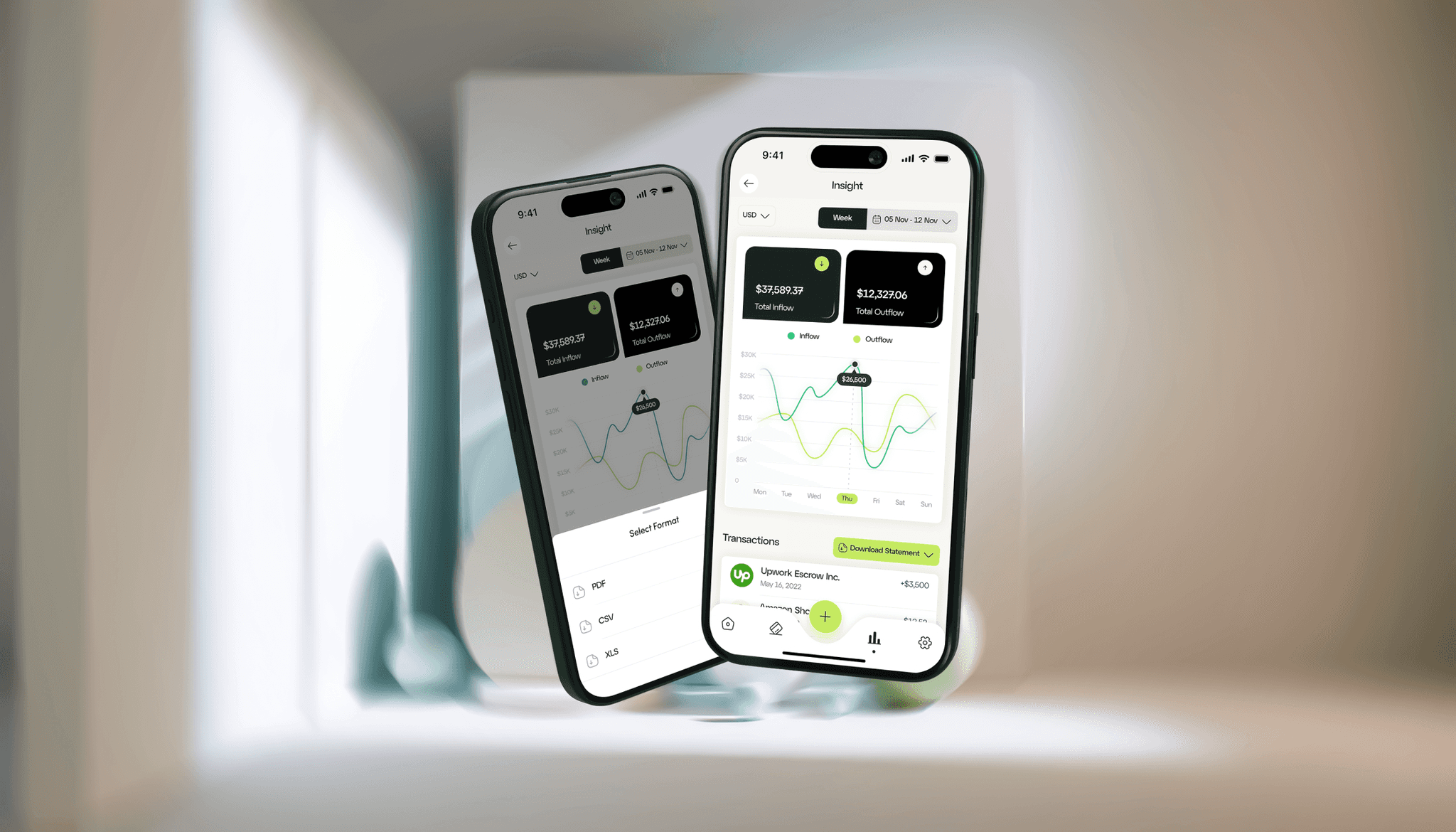

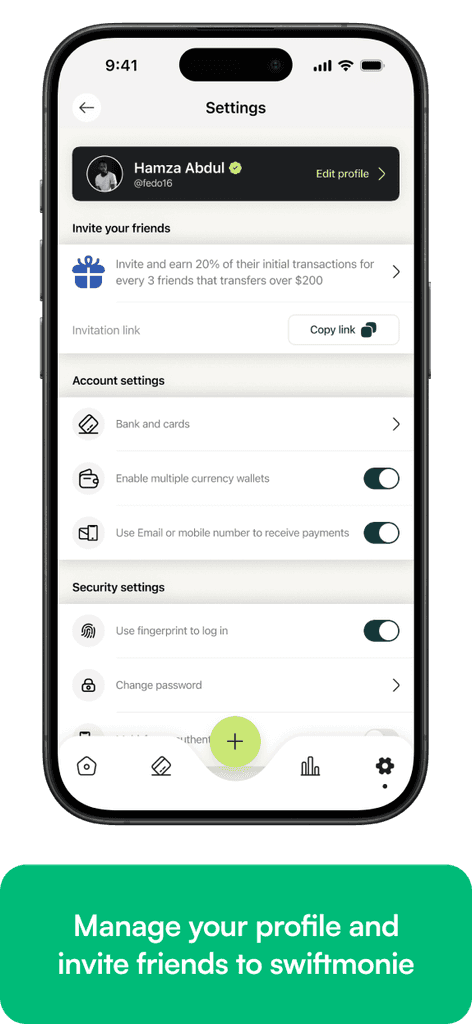

The App design

We combined insights from research and the branding to craft the mobile app design, ensuring it is clean and the layout structure is straight-forward and user-friendly.

The design was also modern and unique, exhibiting the strong and vibrant identity ensuring swiftmonie is recognizable as customers use the application.

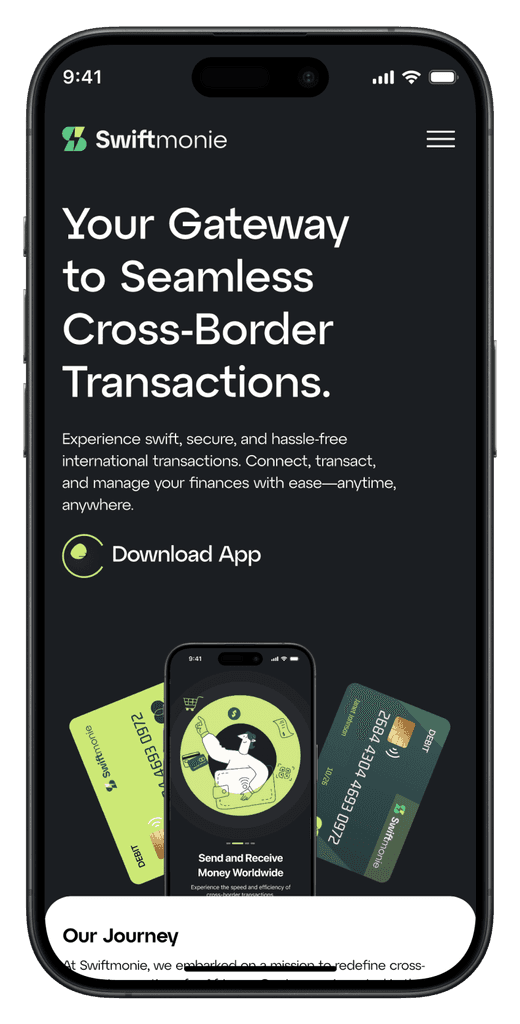

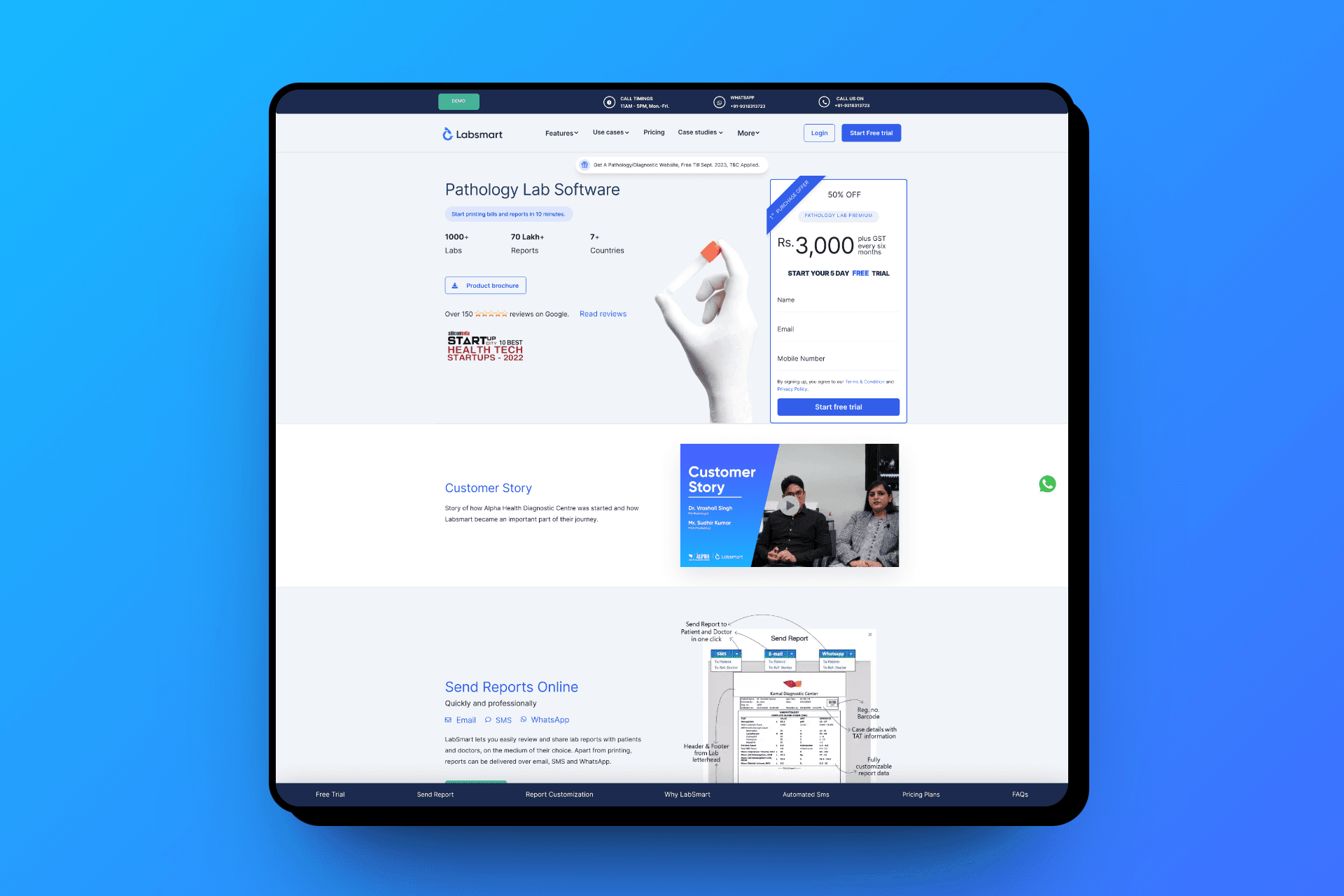

The web landing page

Swiftmonie's landing page is where engagement begins and the brand story unfolds. Designed to be both informative and inviting, it serves as a digital welcome mat to users seeking financial empowerment through seamless cross-border transactions.

Our strategy was to blend visual storytelling with clear, actionable information. The design reflects Swiftmonie's innovative approach to finance, with user needs at the forefront.

What we learnt

Working on Swiftmonie truly transformed the meaning of collaboration for me. Not only did I put complete trust in the team, but also felt an extreme amount of responsibility because I knew that we all depended on each other to make the best product possible for our users

Working on this project also gave us insights on the intricacies involved in building a fintech applications. One of the major aspect of this was when we wanted to choose API’s that will work for what we wanted.

We considered flutterwave, adyen and paypal. Each of them had their pros and cons. After our research we decided to choose adyen as flutterwave is a direct competitor in Nigeria and Paypal had banned Nigeria on their platform.

What we did well

We took initiative on a problem worth solving. Having a team in place that understands the mission and is fully devoted to building a meaningful product is amazing. We would meet up every weekend for five months and would work all day on Swiftmonie. One of the main things that we did well was the fact that we remained consistent.

While working on side projects, it can be easy to take it slow or stop working when life throws unexpected things your way. Making sure that everyone is held accountable while hitting our weekly goals was imperative. I believe that we all did a great job at keeping each other motivated through the tough times and spent enough time to celebrate during the victories.

Challenges overcomed

Navigating the complexities of financial regulations and designing for various African markets were among the challenges faced. These were overcome through persistent research, user testing and adapting to feedback.

Other challenges faced was working with people on different time-zones, especially when we were doing remote testing with some users on other parts of Africa, we compromised by staying up at night at our own timezone to get it done.

Thanks for reading😇

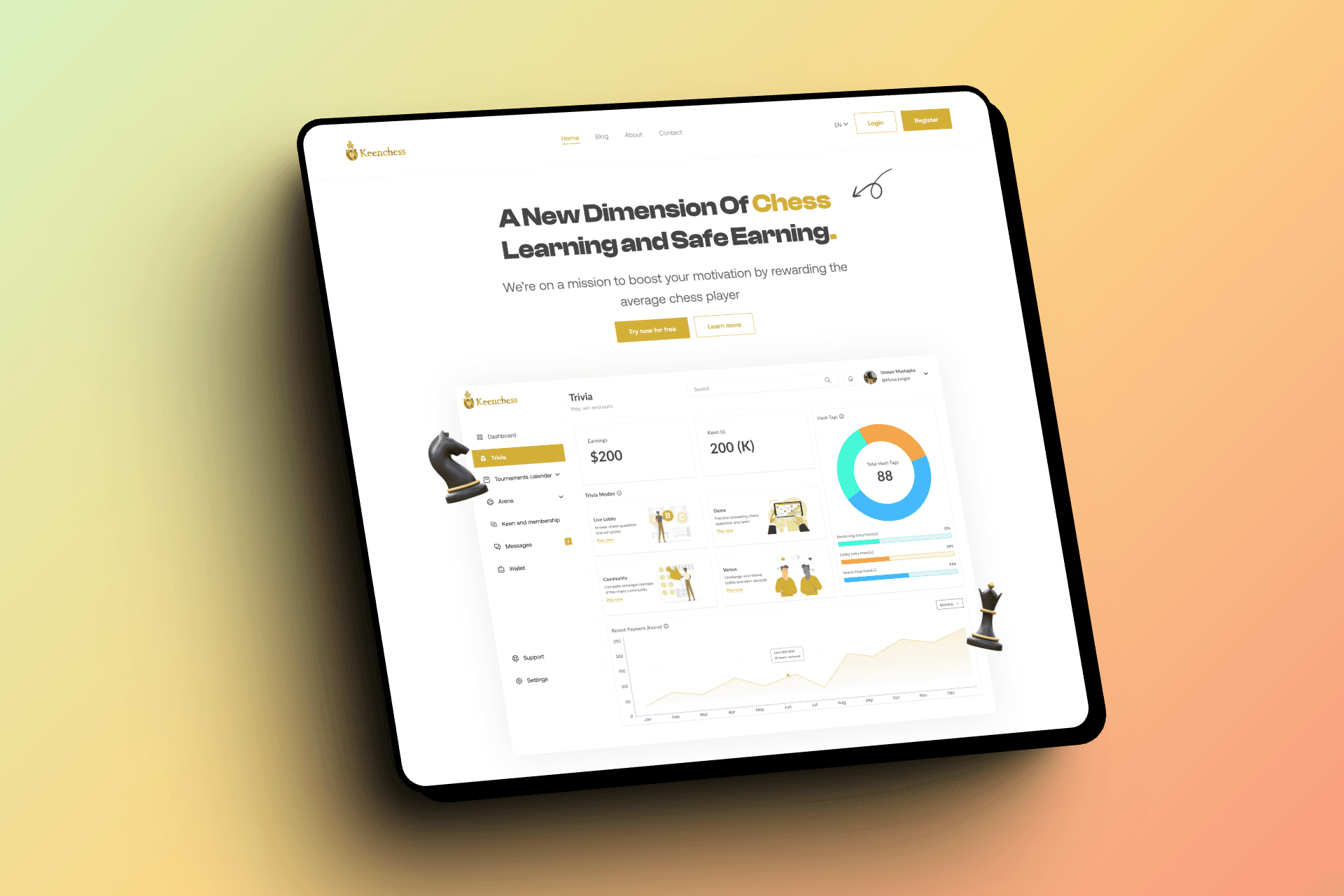

View next 👇🏾👇🏾👇🏾

Lets make something cool together, let’s connect!!